ORS for External Alpha

A growing range of external alpha providers compete to market their investment research expertise to buy-side allocators, from bank research teams and specialist researchers to quantitative AI-type signal providers. For fund managers to implement external Alpha they need to translate their signals into risk-controlled portfolios. Sherpa Funds Technology helps clients leverage external Alpha by constructing systematic portfolios that express managers’ desired themes and risk characteristics.

Monetize External Alpha

The Sherpa framework provides a structured process to translate individual investment ideas from any external alpha provider into an investable product that best expresses that Alpha.

ORS allows managers to specify return, risk and operational constraints to maximize research and Alpha providers’ value.

SFT works with both individual research providers and managers to create unique, optimal and executable portfolios that express the provider’s Alpha in a manner consistent with the manager’s goals.

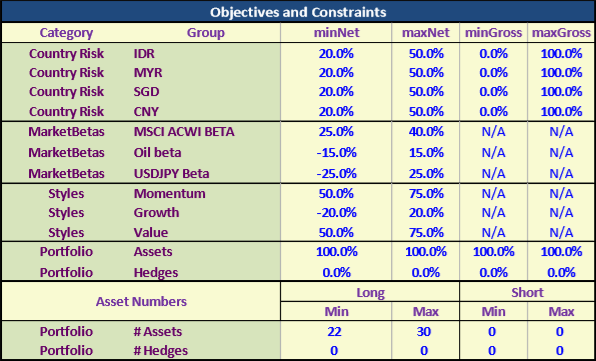

Tailor the Risk

The ORS system uses proprietary ex-ante risk management techniques to mitigate unwanted portfolio risks.

This ex-ante approach to risk management helps managers gain confidence in external signals by treating the inputs as broadly statistically valid, not ‘point’ valid.

The fund manager structures their objectives and constraints to construct risk-mitigated portfolios that capture the external provider’s statistical Alpha.

Build an Alpha Factory

The Sherpa portfolio construction methodology allows fund managers to rapidly onboard research providers and build a scalable Alpha platform.

Sherpa ingests and standardizes the investment ideas provided by external alpha providers and delivers portfolios consistent with the manager’s requirements.

Once the process is established, managers can quickly add new Alpha sources and scale the process while remaining focused on selling to their LPs and growing their business.