ORS for Long Only Managers

In rising markets, long only portfolios tend to exhibit low risk-related performance dispersion. However, a properly constructed portfolio benefits fund performance in more volatile markets while still leveraging the asset selection and research skills of the fund’s managers. Sherpa Funds Technology helps managers in large institutions, sovereigns, insurance companies and elsewhere upgrade their long only portfolio construction, refine their decision making and improve portfolio performance.

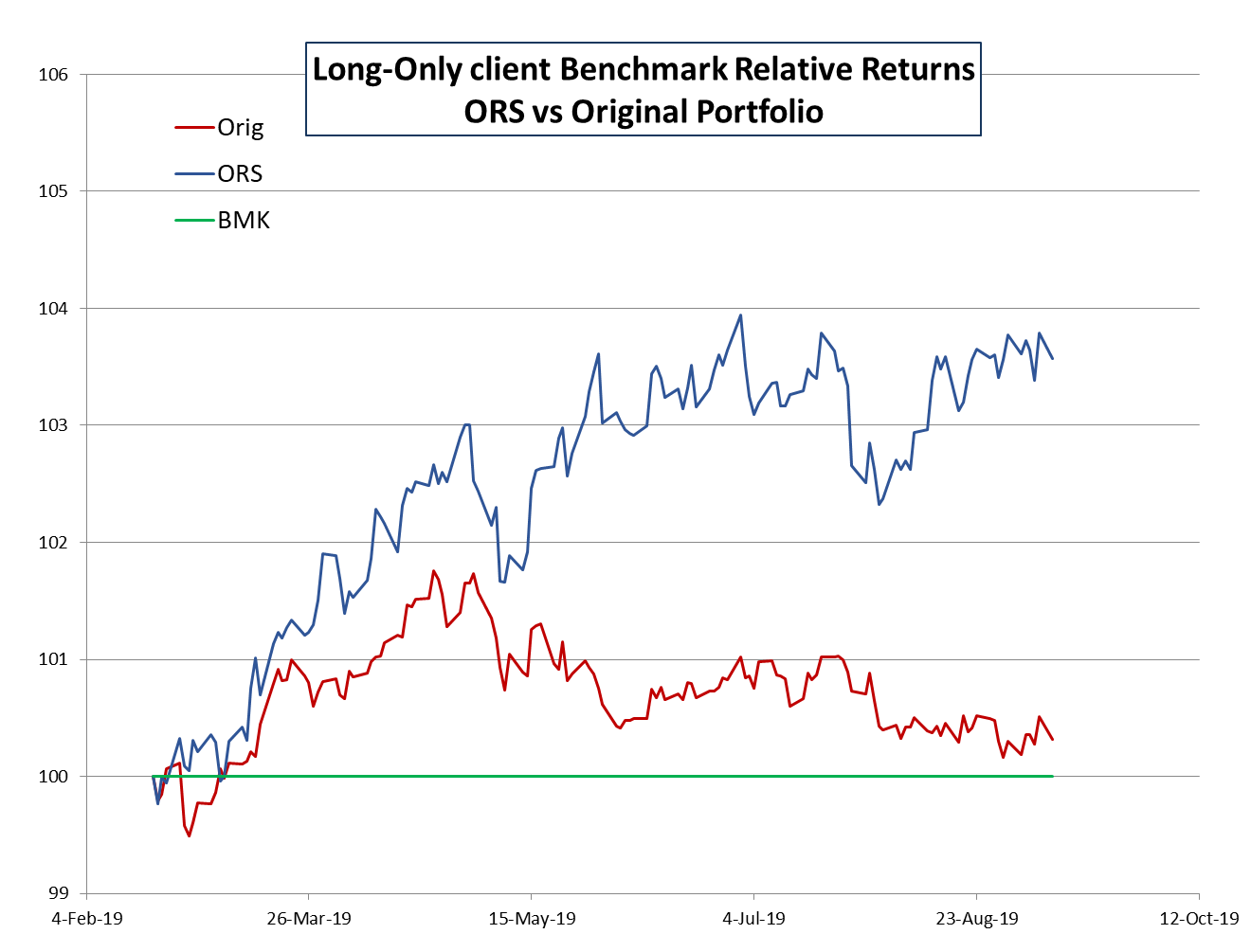

Beat Your Benchmark

ORS helps long only managers produce greater relative returns above and beyond your benchmark.

Sherpa portfolios mitigate risk during periods of market volatility while retaining your asset selection upside during stronger markets.

Our process-driven approach to portfolio construction lets you focus on honing your asset selection to beat the market.

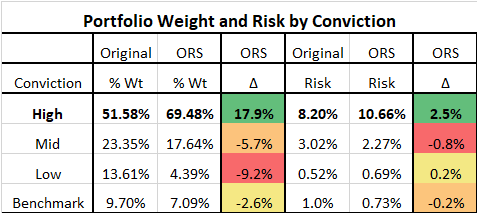

Express Your Convictions

Ensure that the risk driving your portfolio’s performance is consistent with your convictions.

The ORS methodology helps you focus on your convictions so you can take more of the risk you want and less of the risk you don’t.

Sherpa works with you to define a repeatable process to express your convictions. This process leads to portfolios with risk and return driven by your highest conviction ideas.

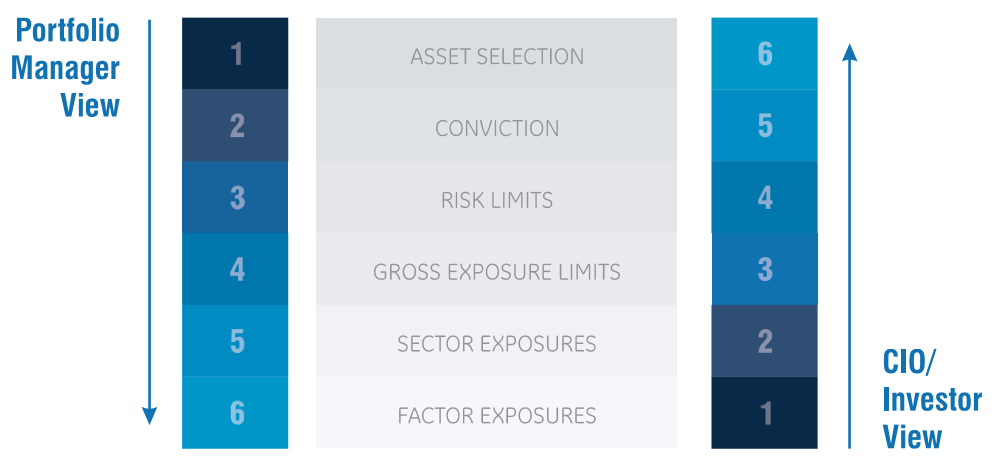

Perform Consistently

The Sherpa portfolio construction approach aligns the portfolio manager and CIO perspectives to provide consistent decision-making regarding portfolio goals.

The CIO determines the “shape” of the portfolio while the PM is freed to focus on selecting the best assets and assigning appropriate convictions.

ORS ensures the resulting portfolio is the best expression of those ideas consistent with all stakeholder objectives and constraints.