ORS for Long/Short Managers

To stand out in a crowded field, long/short managers need to produce absolute returns in a risk-controlled manner to retain investment allocations. Market exposures must be tightly aligned with the fund’s mandate without erasing the manager’s Alpha. Sherpa Funds Technology helps long/short managers at hedge funds, asset managers, family offices and elsewhere implement portfolio construction process to showcase their Alpha while delivering the exposures their investors desire.

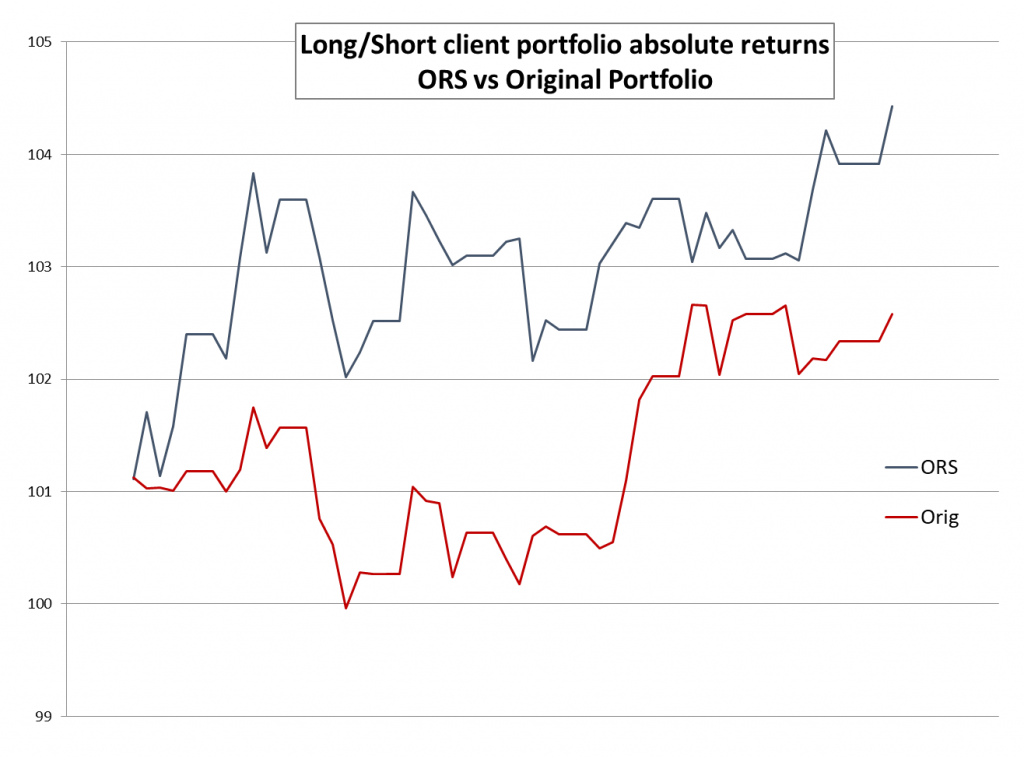

Increase Absolute Returns

Leading long/short fund managers use Sherpa’s process-driven approach to portfolio construction to realize higher absolute returns in a risk-controlled manner.

Over hundreds of real portfolio samples ORS delivered an average of 200-400 bps pa per unit leverage.

ORS helps you construct portfolios that retain the upside of your unique Alpha while optimizing to minimize draw-downs. The result – superior returns when you’re right and lower draw when you’re not.

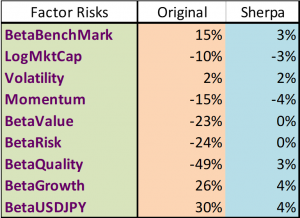

Control Factor Risks

All portfolio stakeholders (PM, CIO or external investors) can target specific factor exposures and risk characteristics at the portfolio and strategy levels using an ex-ante approach to risk management.

ORS neutralises unwanted factor and market risks while expressing desired factor tilts to ensure a compliant portfolio.

The resulting Sherpa portfolio gives you returns that retain the best expression of your Alpha consistent with the exposures desired by your investors.

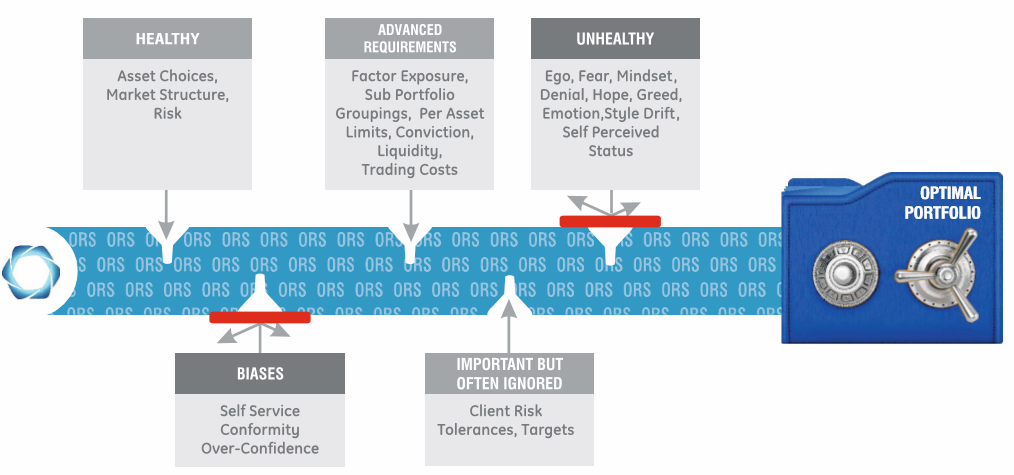

Focus on Your Edge

Sherpa’s process-driven approach manages the many competing inputs in the portfolio construction process to transform your edge into actionable, optimal portfolios.

We work with you to understand your Alpha generation edge and all portfolio requirements in an objective, coherent manner.

Once your Alpha process is understood and the portfolio objectives and constraints are defined, Sherpa manages the entire construction process. As a result, you’re free to focus on developing your unique edge in the market.