by Steven Quimby | Mar 25, 2025 | Portfolio Construction, Process Alpha

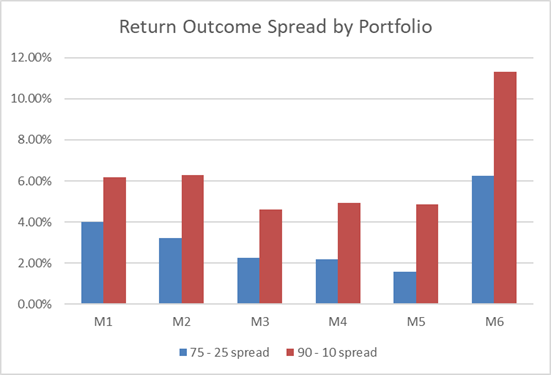

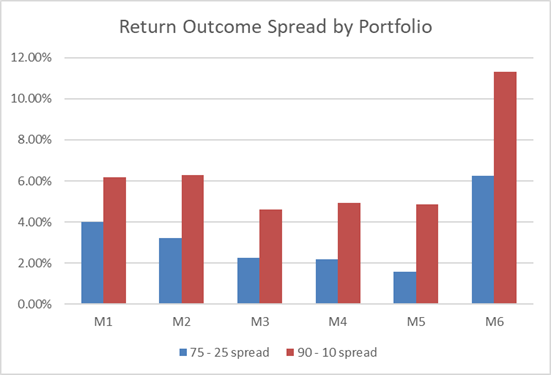

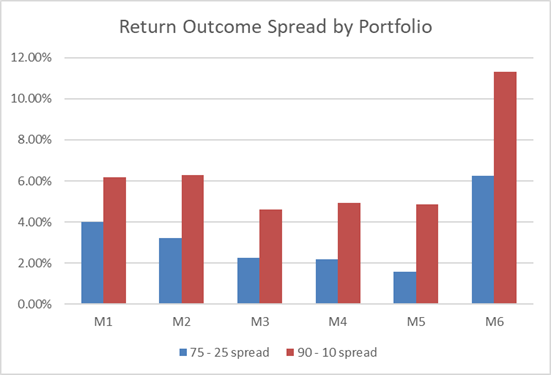

The Impact of Portfolio Constraints Summary: Very few fund managers really understand the impact of portfolio constraints on their ultimate results. While they spend a great deal of time and analytical effort on understanding their alpha ideas, comparatively little is...

by Steven Quimby | Nov 19, 2024 | Portfolio Construction, Process Alpha

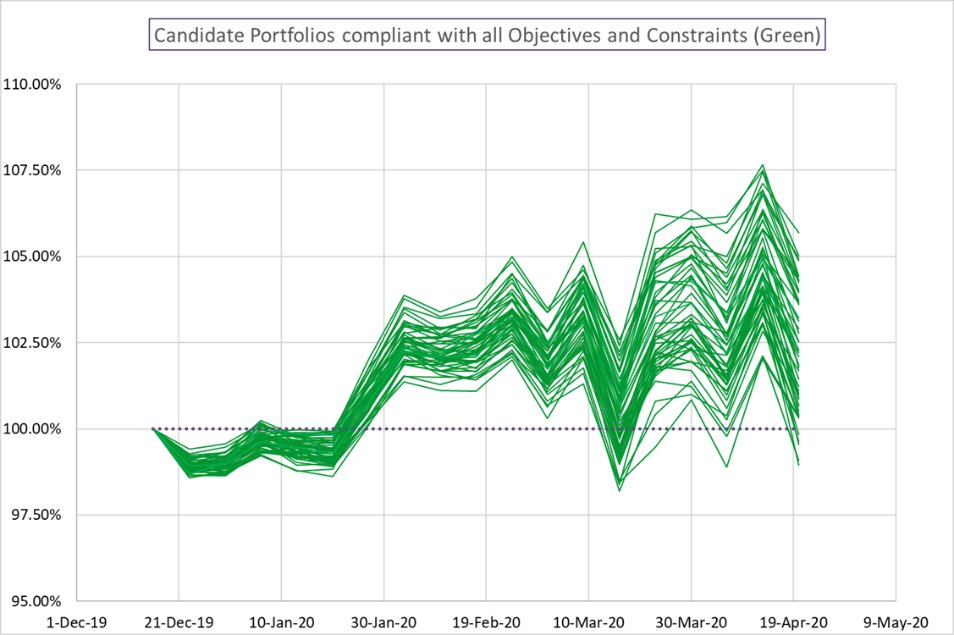

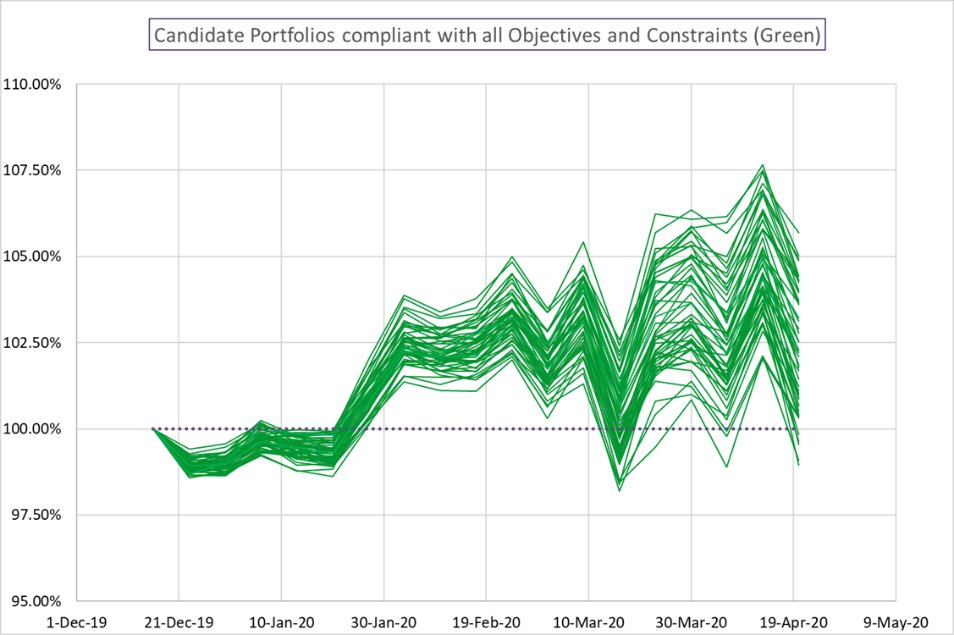

SFT’s Candidate Portfolio Analysis Summary: Fund managers often have an incomplete view of the key drivers of P&L in their portfolio. As a result it is difficult to pinpoint what they’re good at and where they can improve. Sherpa Funds Tech created the...

by Steven Quimby | Oct 8, 2024 | Asset Management, Portfolio Construction, Process Alpha

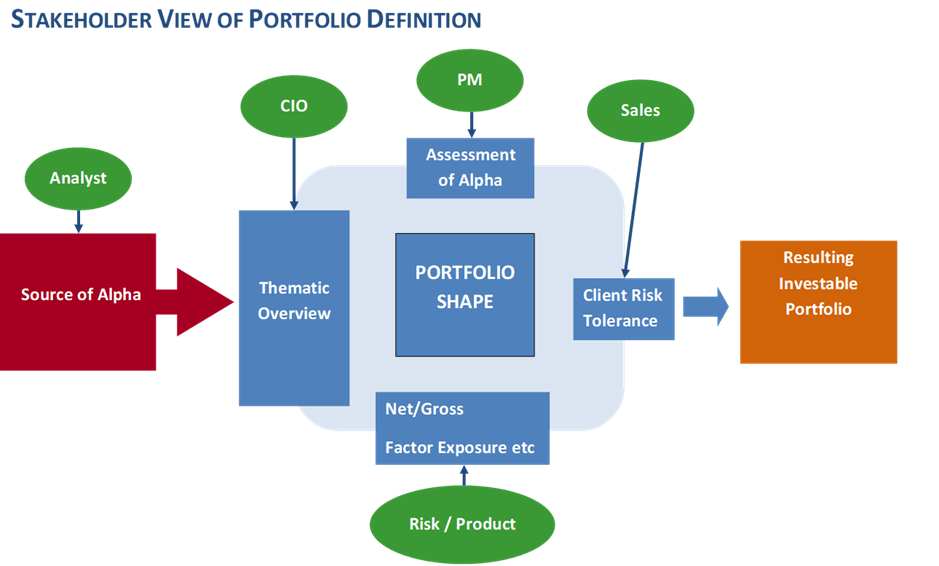

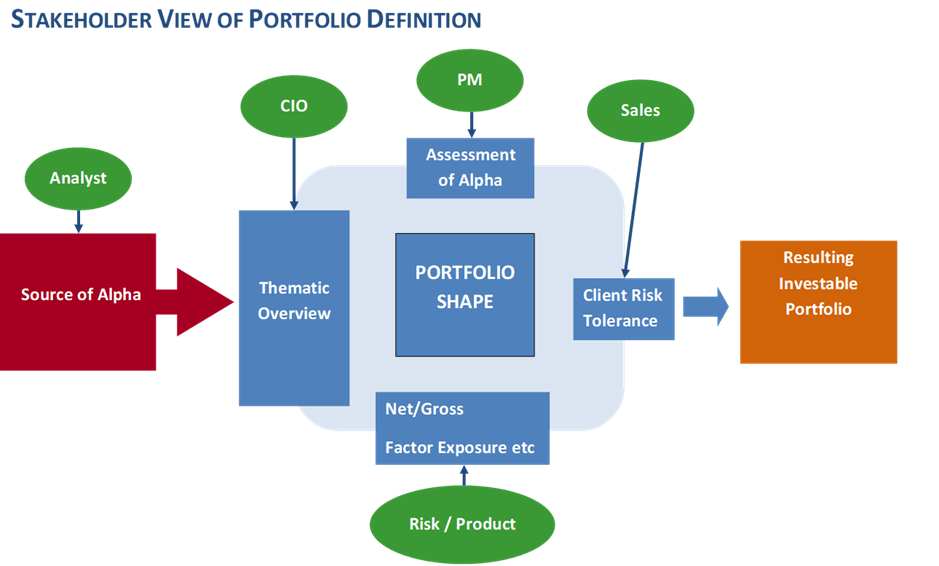

The 3 Cs for Setting Portfolio Constraints Summary: Many fund managers have bad experiences using systematic portfolio construction tools because they ask the wrong question. Without a well-defined portfolio construction problem definition they end up with a...

by Steven Quimby | Sep 23, 2024 | Asset Management, Equities, Portfolio Construction, Uncategorized

Process Alpha Videos Archive The Sherpa team regularly hosts webinars, seminars and speaks at industry events on portfolio construction topics. You can also find our Process Alpha videos on the Sherpa Funds Tech Process Alpha YouTube channel. Subscribe to our channel...

by Steven Quimby | May 3, 2024 | Equities, ORS Systematic Thematics

ORS Systematic Cannabis Portfolio Summary: Systematic portfolio construction techniques can help institutional investors build better thematic investment portfolios. In this example we create a long-only systematic Cannabis portfolio using the Sherpa’s...