The 3 Cs for Setting Portfolio Constraints

Summary: Many fund managers have bad experiences using systematic portfolio construction tools because they ask the wrong question. Without a well-defined portfolio construction problem definition they end up with a garbage-in garbage-out problem. Sherpa Funds Tech helps fund managers create a well-defined portfolio shape to ensure they are asking the right question. Sherpa’s “3 Cs” framework for evaluating a portfolio shape guides managers through setting constraints that produce a realistic, investable portfolio.

Watch the related “3 Cs for Setting Constraints” webinar at the link.

Wrong Question = Wrong Answer

If you ask the wrong question, you will get the wrong answer.

In Sherpa’s experience working with fund managers, most PMs’ struggles with systematic portfolio construction are a direct result of failing to properly define the problem. The old garbage-in, garbage issue.

Systematic portfolio construction techniques are mathematical tools to solve a particular portfolio construction problem. In this post we will introduce concepts that managers can use to better define their problem so that they get a useful, practical answer.

What is the Shape of Your Portfolio?

A portfolio’s “Shape” is a broadly consistent set of characteristics that ensure the portfolio is consistent with organizational and investor requirements even while the asset selections in the portfolio may frequently change.

A well-defined “Shape” is a critical part of a robust portfolio construction process. PMs must fully define the “Shape” of their portfolio to use systematic techniques to build the best portfolio to express their asset selections and market views.

In systematic portfolio construction terms, this “Shape” determines what possible portfolios can be built from a given set of asset selections.

However, many PMs struggle to express the full “shape” of an acceptable portfolio prior to construction. Instead they rely on a combination of internal nudges (from risk, trading, etc) and “know-it-when-I-see-it” assessments after the fact.

This typically leads to a fuzzy portfolio construction process. The PM is left adjusting individual positions to create a workable portfolio rather than building the best portfolio that meets their “shape” requirements.

Whether their portfolio is constructed heuristically or systematically, PMs can make better decisions when the shape of their portfolio is well-defined ex-ante.

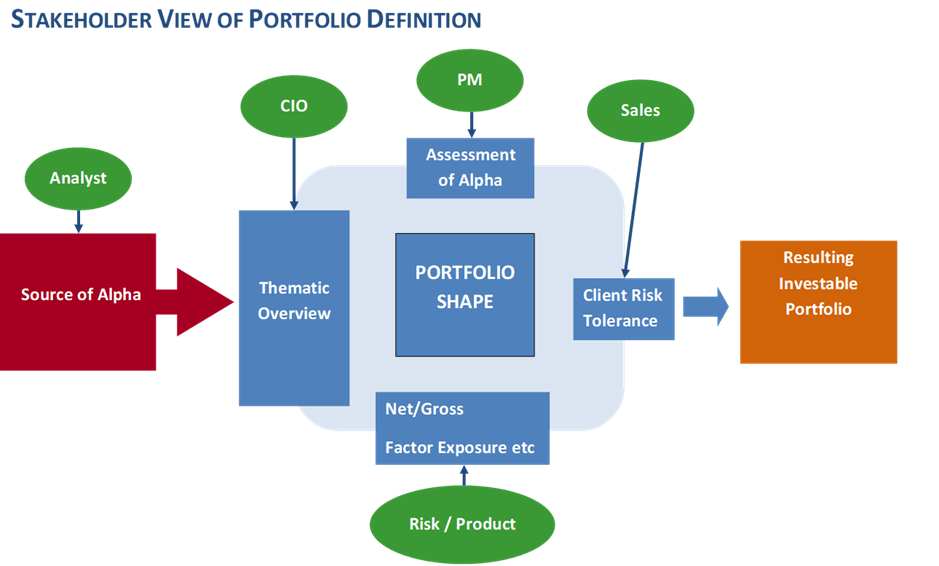

How is Shape Set?

In practice, defining the desired shape of a portfolio requires bringing in inputs from many different sources. A well-defined portfolio shape must:

- Meet all stakeholder requirements

- Fit the PM’s desired style and views

- Take the risk the PM wants it to take

Other Process Alpha blog posts and webinars have frequently discussed the 3rd topic. Here we will focus on the first two.

The Sherpa Process Alpha approach helps PMs build a well-defined portfolio shape so they can benefit from systematic portfolio construction techniques.

- Determine all the stakeholder requirements of the portfolio

- Add your personal requirements and views as the PM

- Codify all those inputs as constraints

- Evaluate and understand the full portfolio shape definition using “the 3 Cs”

- Complete

- Coherent

- Consistent

Stakeholder Inputs on Portfolio Shape

In addition to the Portfolio Manager themselves, many different stakeholders may have input into their portfolio’s shape.

Each stakeholder has different concerns that the PM must synthesize and resolve in defining the portfolio shape. Some examples of these stakeholders and their concerns may include:

- CIO – thematic overviews eg. factor tilts, regional tilts

- Risk – limits on risk metrics eg. VaR, vol, etc

- Trading – market-driven or liquidity limits eg. days % ADTV, market cap concentration

- Sales – client risk tolerance and investor wants eg. constraints to fit market trends

- End Investor – desirable filters for inclusion / exclusion eg. ESG overlays, excluded sectors

- Legal – regulatory limits for fund structure eg. US mutual fund concentration limits

A well-defined portfolio shape is sensitive to all these concerns.

If the PM builds a portfolio that breaches regulatory or risk limits it will not be implementable. If it is not consistent with what the end investors desire it will struggle to retain assets.

PM Input on Shape

Beyond the requirements imposed by other portfolio stakeholders, the PM must also make intentional decisions about how they want the portfolio to be built.

This may take the shape of further tightening overly broad constraints. An example we frequently see is setting maximum size limits below the absolute max to avoid having to trim strong performers.

PMs might also wish to implement conscious tilts such as over/underweighting a region, country or sector.

In our experience this is an area PMs often struggle with defining precisely!

However, at the end of the day, the PM owns the shape of the portfolio as an active manager.

Resolving the requirements of different portfolio stakeholders into the final portfolio shape definition in a manner that still expresses the PM’s desired views is an important, but oft-ignored, part of the portfolio management process.

Doing so requires understanding how to translate those requirements into constraints and ensuring that they form a complete, coherent, and consistent definition of the portfolio’s shape – Sherpa’s 3 Cs for setting up the portfolio construction problem.

Understanding Constraints

Before we discuss how to evaluate how a full set of constraints make up a portfolio’s shape, let us establish a few ways to think about individual constraint statements.

Constraints can be placed on a portfolio at three basic levels.

- Portfolio Level constraints are placed on characteristics of the entire portfolio. Examples would include concentration metrics, risk metrics or other characteristics of the full portfolio.

- Group Level constraints are placed on groupings within the portfolio. Examples include country/sector positioning, strategy groupings, market cap or any other way the business or PM groups assets within the portfolio.

- Asset Level constraints are placed on individual assets within the portfolio.

A Complete portfolio problem definition will typically have constraints at all 3 levels.

A sample of the most frequently applied equity long-only constraints Sherpa sees in at each level are below.

Portfolio-Level

- Net / gross exposures

- Total Weight

- % of Assets in Top 10 Holdings

- Active Share

- # of Holdings

- Amt of portfolio that can be liquidated in X days as a % of ADTV

- Factor Exposures

Group-Level

- Sector

- Country

- Currency

- Conviction

- Strategy

- PM Classification

Asset-Level

- Individual asset min/max wt

It is also important to distinguish between Hard and Soft constraints.

- Hard Constraints – These constraints are binding on the portfolio and must be considered; there is no room to fudge.

- Soft Constraints – These constraints are broad guidelines. Going outside the boundaries of soft constraints is possible, but the PM may need to explain why they have done so.

When evaluating constraints for consistency and determining their impact a Hard constraint cannot be changed. A Soft constraint is more of a want than a need and might have more flexibility with a given range.

The 3 Cs for Setting Constraints

At Sherpa Funds Tech we use a framework we have developed called “the 3 Cs” to evaluate the full portfolio shape. This helps the PM and our team ensure we have the right problem definition to drive the portfolio construction process.

For a portfolio shape to be well-defined, the constraint set must be:

- Complete – Includes all inputs needed to express both PM and stakeholder requirements

- Coherent – All included constraints are explicit, concrete and sensible

- Consistent – Constraints don’t conflict with each other, asset selections or stated PM aims

Let us look at each of the three in practice with some live examples.

Complete

A Complete set of constraints includes all the requirements of all portfolio stakeholders that will drive the construction of a realistic, investable portfolio.

It is critical to assess the portfolio shape definition to ensure it is Complete. If the constraint set is incomplete, the portfolio construction process will likely produce a portfolio that fails to fulfill unstated constraints. The output of the portfolio construction process at that point is not usable!

A Complete set of constraints also requires the PM to be explicit about what makes a portfolio practical to them beyond “know it when I see it.”

This is typically a challenge for traditional PMs when using systematic techniques for portfolio construction (optimizers, etc). The PM’s personal preferences are not expressed as a Complete set of constraints. As a result, the computer delivers a result that meets their stated requirements but fails unstated requirements and so they reject the process out of hand!

As an example, consider one fund manager we worked with whose stated maximum position size is 5% for their high conviction best ideas. This fund manager typically has around 10 high conviction ideas. By implication, the portfolio could potentially have 50% of its weight in those 10 ideas.

The PM was comfortable with the results of Sherpa’s systematic ORS process for multiple cycles as the top 10 concentration fluctuated between 28%-33%. However, when the same problem definition produced a top 10 concentration of 38% the results were outside of the PM’s comfort zone! The shape definition was incomplete – that level of concentration was too much for the PM.

Adding a subsequent constraint of 35% concentration in the top 10 names made the portfolio shape definition Complete and usable for the PM.

Coherent

In addition to being complete, a set of objectives and constraints must be Coherent. They must be clear and understandable.

Any systematic mathematical process needs the problem set to be defined in a way that the maths can understand it.

Practically in portfolio construction, the constraints must be able to be expressed as mathematical statements. There is no limit to the complexity of the statements, but if the objective or constraint is incoherent it cannot be expressed mathematically.

One manager objected to a Sherpa portfolio construction result because it suggested reducing the weight of a particular company in the portfolio, and that they were not allowed to reduce that position.

Sherpa’s response was that this is easy to deal with. We can place an asset level minimum size (or indeed fix the weight) and allow the process to build the rest of the portfolio around it.

The manager objected that this would mean recording in a system that they were not allowed to sell this asset. And the instruction ‘not to sell’ could not be recorded in any system due to compliance reasons.

This is an incoherent constraint: it is not possible to benefit from the mathematics without first resolving the issues that generate incoherent constraints.

Consistent

A Consistent set of constraints ensures there are no conflicts between constraints and reasonable portfolios can be made that comply with the constraint set.

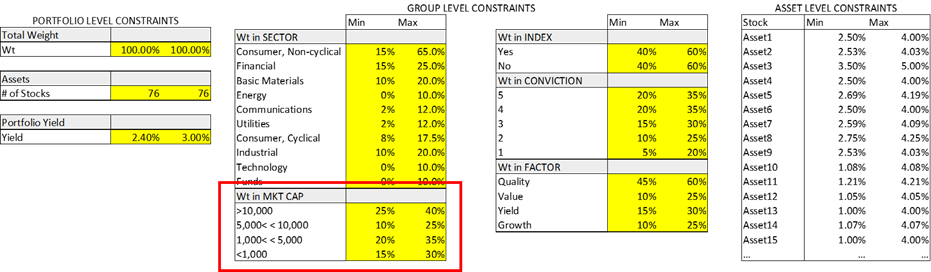

To illustrate the importance of Consistent, well-defined constraints and the impact on changing constraints we will look at an example with data.

This is a real anonymized long-only developed market equity portfolio with real constraints from the PM.

Portfolio Level Constraints:

- Portfolio yield Min 2.4%, Max 3.0%

- Total weight (Cash handling) Must be 100% – no cash

- # of Assets Must retain all stocks in portfolio

Group Level Constraints:

- Sector: Min / Max set by sector size in BMK; generally +/-10%

- Index Membership Min 40%, Max 60%

- Conviction Min / Max set for each PM score

- Factor Min / Max set by factor loading in ideas

- Market Cap Min / Max in small caps set by trading for liquidity

Asset Level Constraints:

- Min and Max Position Sizes per Asset Min 0.5%, Max +4% above BMK

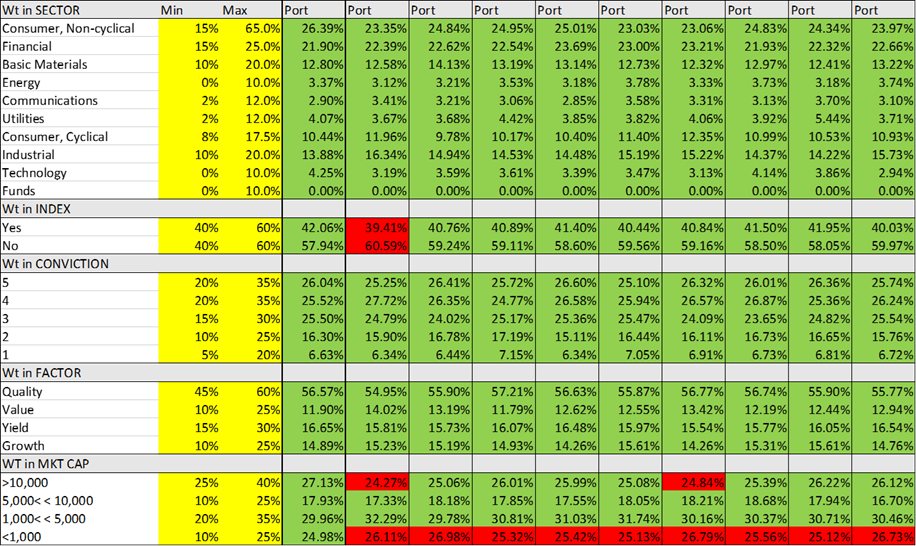

To assess the consistency of the defined portfolio shape and the impact of applying different constraints, we have simulated 80 possible portfolios using the stated problem definition.

The problem definition is structured here as an input for the systematic portfolio construction engine.

Examining the 80 simulated Candidate portfolios illustrates the impact of constraints that are not consistent with either the asset selections or other constraints.

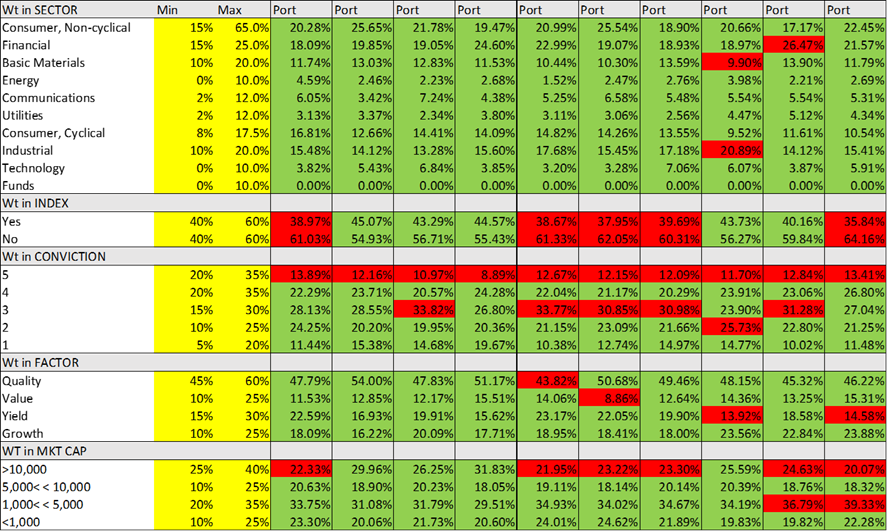

Simulation 1

The results of our first simulation are shown here. A GREEN cell is compliant with constraints, while a RED cell is not compliant. Any RED cell in a binding HARD constraint means the portfolio does not have a shape acceptable to the PM!

that

that

In this first cut 80 out of 80 simulations were not compliant with the constraints. This suggests inconsistency between the different constraints when paired with the PM’s asset selections.

At first glance we can see the Wt in CONVICTION was frequently an issue. There were consistent, often dramatic, underweights in the highest conviction ideas scored 5.

Revisiting our full shape definition before gives a hint as to the possible issue. The portfolios were consistently underweight in the highest Conviction (score 5) assets and these assets had the same minimum values as all other assets. Allowing high conviction ideas to be sized the same as lower conviction ideas resulted in inconsistent outcomes.

In practice the Asset-Level constraints are not on their own consistent with the shape objective of having a larger allocation to high conviction ideas.

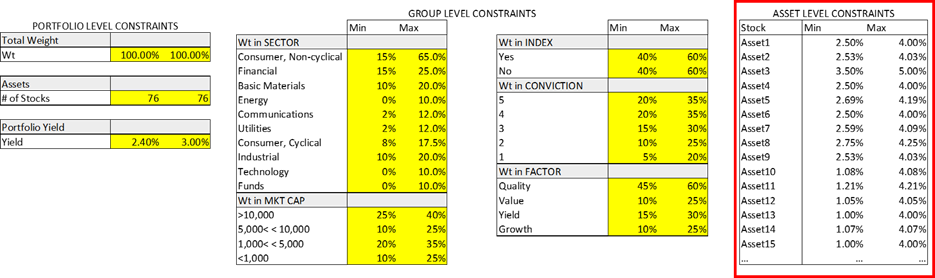

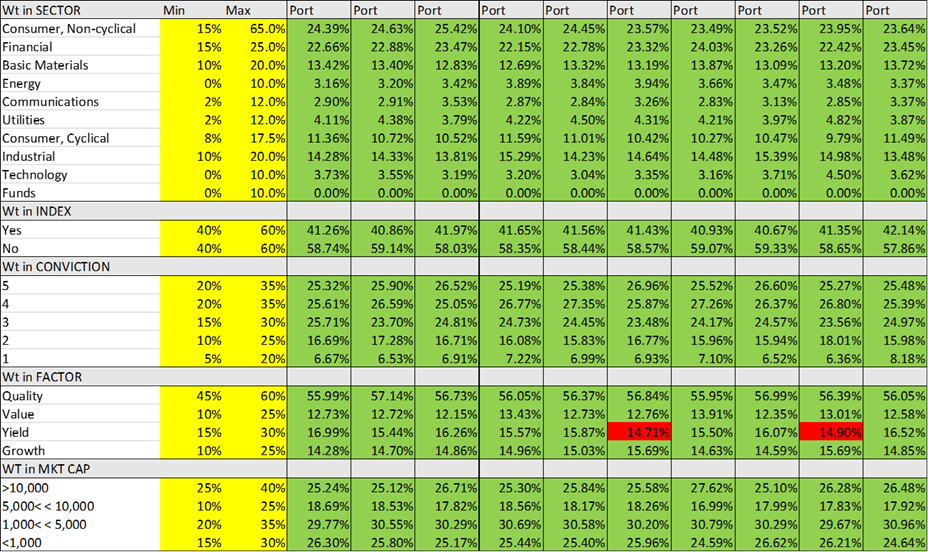

Simulation 2

Changing the Asset-Level constraints to allow varying minimum and maximum weights based on conviction score can help address this problem. We’ll update the portfolio shape and run a new simulation.

The new simulation has far fewer red cells – most of the constraints are met.

However, while the conviction issue is resolved, we can see this has raised a new problem. Many of the portfolios fail the market cap constraint. As a result, only 11 out of 80 portfolios have a compliant shape!

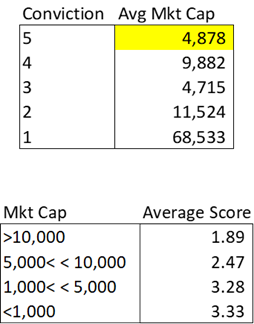

Looking further into this problem, we can see the driver of the inconsistency. The highest conviction ideas are disproportionately in small cap names.

The Avg Mkt Cap for Conviction 5 “best” ideas is very low, and the Average Score in the bottom two market cap buckets is relatively high.

To resolve this the PM had to determine which constraint was SOFT – ie what were they willing to change? Did they want to allow greater weight in small cap names or lesser weight in high conviction names?

Simulation 3

Ultimately the PM wanted to have sizable exposure to their high conviction views in spite of the resulting size bias and made a change to the market cap constraint.

Allowing more weight in small caps produced more consistently compliant portfolios.

Very few constraints were violated – 63 out of 80 portfolios have a compliant shape. There is room for further refinement but the definition is very close.

Portfolio Shape is Well-Defined

The portfolio construction problem as it was initially set up produced results that struggled to reconcile the PM’s asset selections and desired shape. While the portfolio shape was COMPLETE and COHERENT, it was not yet CONSISTENT.

At this point many PMs might throw up their hands at the result of the process, not realizing that they were asking the wrong question!

Further understanding and refining the constraints set on the portfolio helped construct portfolios that were consistent with the organizational goals and the PMs views.

Critically, this required iteration to drill down to the real issues as well as intentional decision-making to resolve them. However, once that was complete the PM had a well-defined portfolio shape and could benefit from systematic portfolio construction techniques.

Right Shape = Right Question

Defining the right shape means you are asking the right question!

When the portfolio’s shape is well-defined you can avoid the garbage-in garbage-out problem many PMs encounter with systematic portfolio construction. Further, you can begin to analyze and quantify the impact of different constraints and shaping decisions.

Future posts will discuss how to better understand the impact of your portfolio shaping decisions.

To see the potential impact of improved portfolio construction on your portfolio and learn more about refining your team’s portfolio construction process, get in touch with the Sherpa team or sign up for the SFT mailing list here.