by Steven Quimby | Jul 13, 2022 | Asset Management, Portfolio Construction, Process Alpha

Have You Considered Running a Center Book? Multi-manager and multi-analyst fund management organizations generate a huge amount of asset selection information with the potential to add alpha to the firm, but few truly maximize the value of that information in the...

by Steven Quimby | Apr 11, 2022 | Portfolio Construction, Process Alpha

Do You Understand Why Portfolio Construction Matters? Traders often say the right idea at the wrong time is as bad as the wrong idea. Similarly, a poorly constructed portfolio of good ideas can destroy most, or even all, of the alpha in a PM’s stock selection. Despite...

by Steven Quimby | Jun 23, 2021 | Portfolio Construction, Process Alpha, Risk Management

Know Your Factor Risk Bets Summary: Residual factor risk is a critical consideration in the portfolio construction process. The reversal of long-standing factor trends in 2020 and 2021 have underlined the importance of Knowing Your Factor Bets. Factor shocks can...

by Steven Quimby | Apr 9, 2021 | Equities, Portfolio Construction, Process Alpha

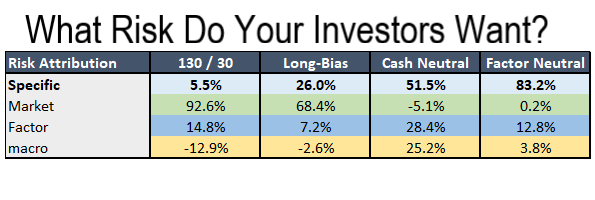

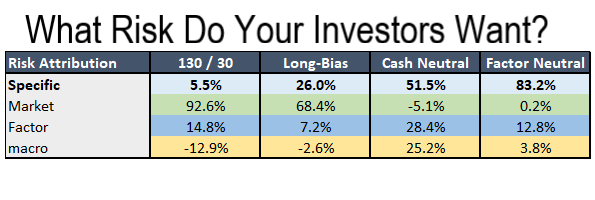

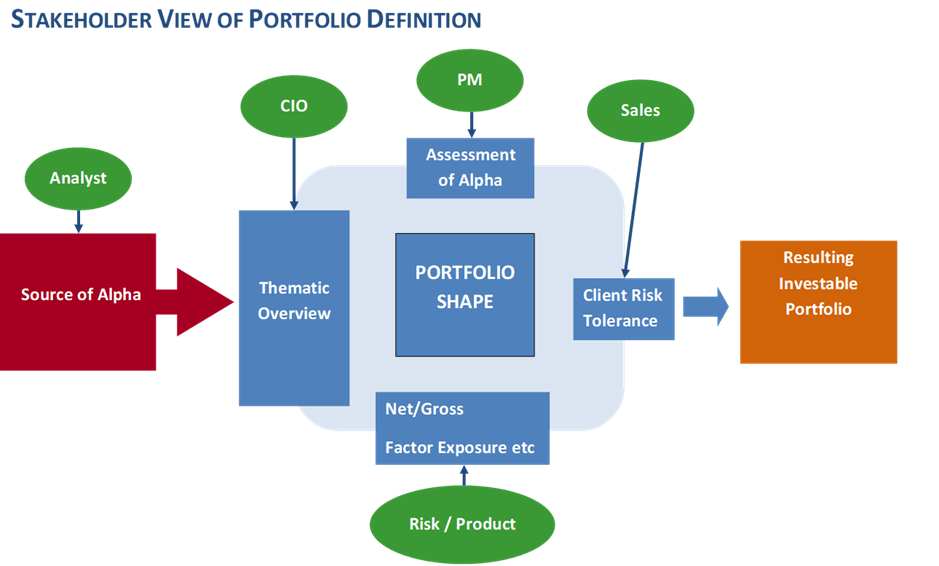

Delivering The Long/Short Equity Portfolio Your Investors Want Summary: The equity long/short space is a very large but extremely competitive portion of the hedge fund universe. Different long/short equity portfolio strategies such as long-bias or pure market-neutral...

by Steven Quimby | Mar 25, 2021 | Portfolio Construction, Process Alpha

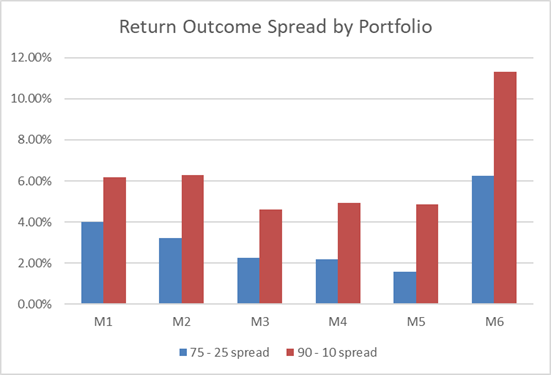

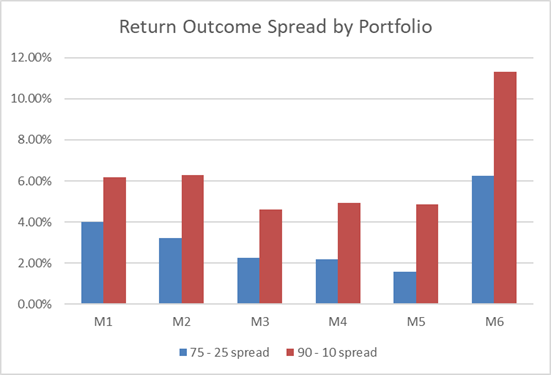

The Impact of Portfolio Constraints Summary: Very few fund managers really understand the impact of portfolio constraints on their ultimate results. While they spend a great deal of time and analytical effort on understanding their alpha ideas, comparatively little is...

by Steven Quimby | Mar 8, 2021 | Asset Management, Portfolio Construction, Process Alpha

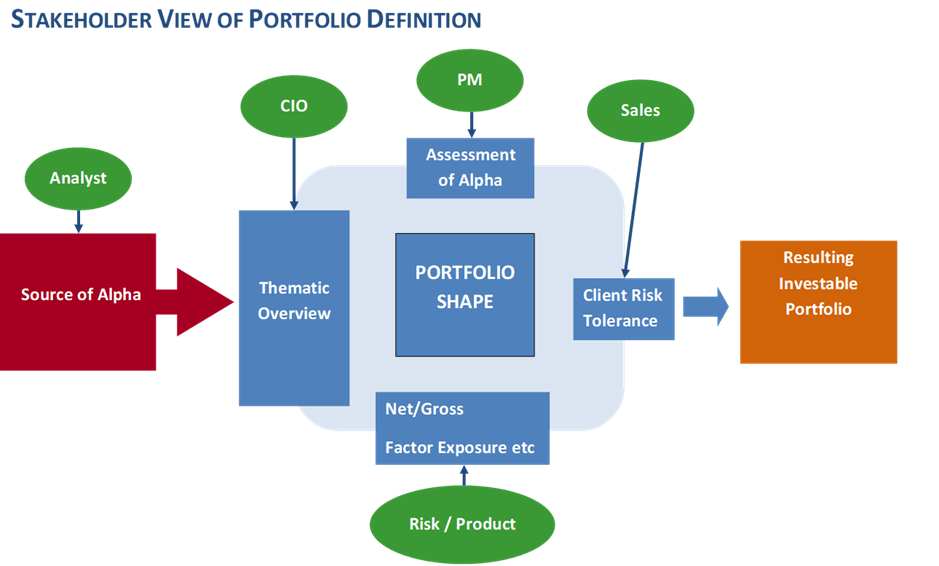

The 3 Cs for Setting Portfolio Constraints Summary: Many fund managers have bad experiences using systematic portfolio construction tools because they ask the wrong question. Without a well-defined portfolio construction problem definition they end up with a...