ORS Systematic Cannabis Portfolio

Summary: Systematic portfolio construction techniques can help institutional investors build better thematic investment portfolios. In this example we create a long-only systematic Cannabis portfolio using the Sherpa’s process-driven approach and Optimal Risk Sizing (ORS) maths engine. Systematic thematic portfolios like this can deliver more exposure to your thematic views with better risk control than traditionally constructed portfolios. Summary fact sheet can be downloaded here.

After years of growing retail interest in individual cannabis-linked stocks, 2020 saw a surge in assets into thematic ETFs in the space. As of publication, ETF.com lists 9 different marijuana ETFs trading on the market – 6 above $100 million in AUM and 1 over $1 billion. Cannabis has proven to be a growing, popular thematic space and not simply a flash in the pan.

Many of these ETFs posted huge gains off the COVID 2020 market lows and the start of 2021. As an example, the YOLO ETF gained more than 40% in 2020 and as of end April 2021 showed 150% 1 year gains.

However, investors in the cannabis sector have had to endure substantial volatility and large drawdowns.

Given the rapidly evolving policies on marijuana in North America, investors in thematic Cannabis products may have to accept sizable risk going forward.

In this post we’ll explore how investors can apply a systematic portfolio construction process to create a customized Cannabis portfolio that meets their unique requirements. Using this systematic process, we’ll create an executable Cannabis portfolio that delivers more of the risk you want and less of the risk you don’t want.

All of the inputs to this thematic portfolio – the stock list, scores, risk objectives, constraints – can be customized per investor requirements. To explore the concept with your own ideas get in touch with Sherpa, or read on to learn more about how the process works.

Defining our Systematic Cannabis Portfolio Problem

The most critical part of implementing a systematic portfolio construction process is getting the inputs right.

This requires asking the right questions consistently to define all of the inputs to the portfolio construction problem in a coherent manner.

We will use this two-step framework below (more detail on the framework here) to set up the problem and then construct our sample Robotics portfolio:

Step 1 – Generate Investment Ideas

-

- How do you determine which assets to include in the portfolio? (Selection)

- How do you differentiate between the assets? (Scores)

Step 2 – Apply the Ideas to Create an Investable Product

-

- What risk do you want to take? (Risk You Want)

- What risks do you NOT want to take? (Risk You Don’t)

- What additional operational constraints are on the portfolio? (Objectives and Constraints)

Step 1 – Generate Investment Ideas

Selecting the right stocks to provide exposure to your thematic idea is the first step of building a systematic thematic portfolio.

However, Sherpa team are not cannabis experts or stock pickers! So in this example we’re using two well-established thematic ETFs to provide our list of Cannabis stock.

Sherpa also conducts no fundamental company research and has no particular views on any of these stocks. So to establish a forward-looking view we’ll use a publicly available Analyst rating to provide preference scores for the stocks in our portfolio.

Selection

For this example we’ve used two global ETFs – YOLO and THCX – in the Cannabis space to provide exposure to both American and Canadian stocks.

Given the number of products in the space an investor could easily substitute any other ETF, but given the substantial overlap in stocks this provides sufficient coverage of the space. An investor conducting their own fundamental research could further add or remove names from the list, or even generate a whole list on their own.

Combining these two lists gives us 53 individual stocks from which to construct our Cannabis thematic portfolio.

Scores

With the list of stocks eligible for the portfolio determined, the next step is to score the assets. The scoring process establishes a forward-looking view on the relative prospects of each asset in the portfolio.

In most cases, a fundamental manager would generate scores or views for this step as part of their research process. Examples include conviction scores, estimated values, price targets, or any other quantifiable way to distinguish between the analyst’s views on the asset.

This scoring process establishes a forward-looking view on which stocks are more likely to drive potential results. While a systematic analysis could be run without any scores, the results would inevitably

For this exercise we’ll use Bloomberg’s Analyst Consensus score of 1.00 to 5.00 for each stock.

Step 2 – Shape Portfolio

After selecting and scoring the stocks, we must define the portfolio’s “shape”. For more information on defining a good portfolio “shape” see our post on the subject here.

Setting the desired portfolio “shape” ex-ante is critical in building a portfolio most likely to perform as desired.

In simplified terms, shaping the portfolio requires establishing

- the Risk You Want,

- the Risk(s) You Don’t Want, and

- any operational Objectives and Constraints on the portfolio.

The Risk You Want

This example will construct a long-only portfolio for an apples-to-apples comparison to off-the-shelf ETF products.

In our next post we’ll construct a long-hedged expression of the theme designed to better isolate the Cannabis theme versus broad market risk.

To mirror a traditional fundamental active equity investor’s goals we’ll look to maximize exposure to our scores so the portfolio benefits from their information content. The resulting portfolio’s risk and performance should be driven by the strength of the scoring.

Broadly higher Analyst Consensus scores should garner higher weights while lower Analyst Consensus scores get lower weights.

Risk You Don’t

Given the high realized risk of Cannabis investing in the past, we’ll construct this portfolio to reduce damaging downside volatility without compromising on potential upside.

Other portfolio “shape” definitions might seek to mitigate market beta, factor risks, macro factors or any other exposure for which an investor wishes to control.

Objectives and Constraints

The last step is to specify any operational constraints around liquidity, turnover, position sizing, country or sector allocations, etc.

As most of the eligible names are US or Canadian listed healthcare stocks, we won’t use any country of sector constraints.

However, we need to specify constraints on liquidity and individual stock weighting to ensure the resulting portfolio is investable. These limits are set so that the portfolio is executable at a minimum of $25mn USD AUM.

To meet this goal position limits have been set at either 6.5% or no more than 10% of the average daily trading volume (ADTV).

These liquidity constraints allow us flexibility in terms of rebalancing the portfolio. Lower trading costs allow the portfolio to be rebalanced as frequently as weekly, making for a more responsive portfolio versus index strategies reconstituted at most semi-annually.

Construct the Portfolios

Once we have all of the inputs in order we can use systematic tool to construct the best Cannabis portfolio in our desired shape.

At Sherpa Funds Technology we use our patented Optimal Risk Sizing (ORS) technology to construct portfolios, though other mathematical tools could also be applied here.

To illustrate the benefits of using a systematic portfolio construction approach, we’ll compare the resulting portfolio with:

- the original two ETFs, YOLO and THCX,

- a simple Risk Weighted portfolio created using all 53 stocks included in our universe

The Risk Weighted portfolio should help with our goal of risk reduction, but it has little sensitivity to our Alpha Scores and may end up compromising on potential upside.

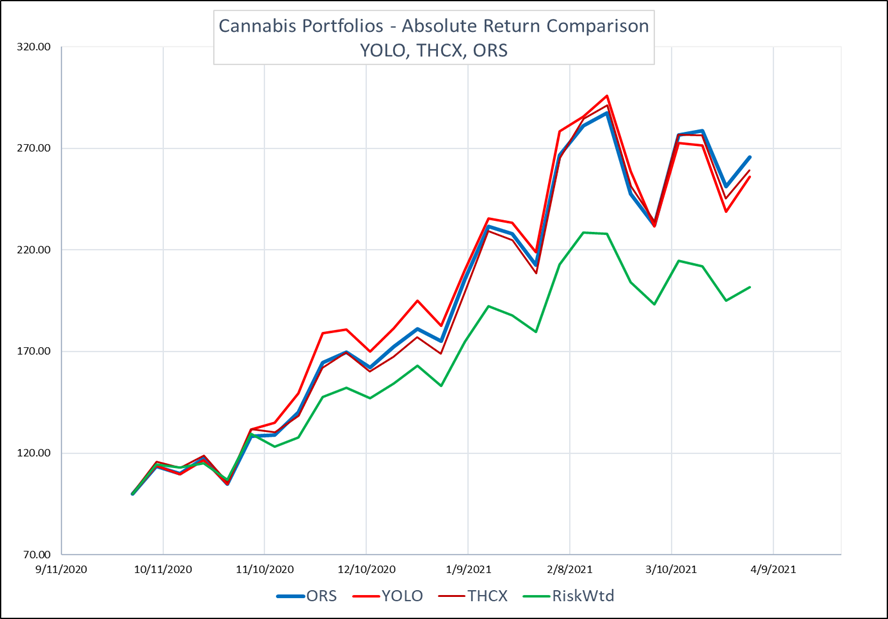

For illustration purposes the following statistics are calculated on the last 6 months of data. This gives a more clear illustration by excluding the H1 2020 COVID drawdown and steep initial recovery which might color the results.

Systematic Cannabis Portfolio Construction Results

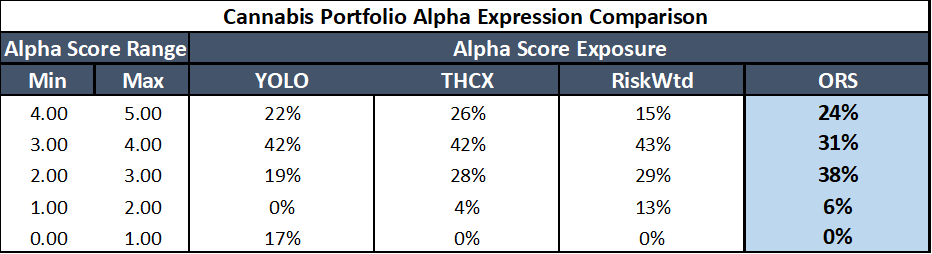

1 – More of the Risk You Want

In shaping our systematic portfolio, we specified that we want to maximize the expression of the asset scores in our portfolio. This means putting more weight in the stocks that have better forward-looking prospects per our scoring.

The Risk Weighted approach substantially reduces exposure to the highest scored ideas with only 15% of the portfolio in the “best” ideas. It also produces a larger allocation to low scored (1 to 2) ideas.

This simple approach reduced the exposure to the Analyst views.

The ORS portfolio has much lower weight in the lower scored ideas (0 to 2), giving more exposure to the Analysts views.

Our systematic ORS portfolio’s forward-looking results should be driven by what we’ve defined ex-ante as the risk we want to take.

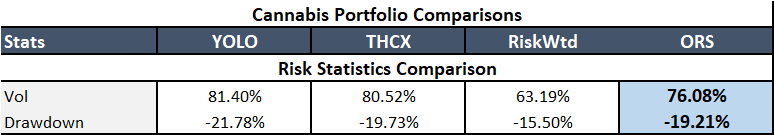

2 – Less of the Risk You Don’t

The traditional risk metrics (volatility and max drawdown) show the high levels of realized risk in our selected ETFs in the past 6 months. 80% volatility and 20% drawdown while the US market traded steadily higher is obviously a different level of risk.

A simple Risk Weighted portfolio dramatically reduces both volatility and drawdown when compared to the ETFs.

However, given the volatility in the market and theme even this simple risk-focused methodology yield a risky portfolio.

The ORS portfolio doesn’t offer the same level of risk reduction as the Risk Weighted portfolio but it does show lower volatility than the vanilla ETFs. The ORS portfolio also decreased the observed maximum drawdown.

While the systematic result retains the risky nature of the Cannabis theme, it does offer a more risk-controlled expression than the ETF alternatives.

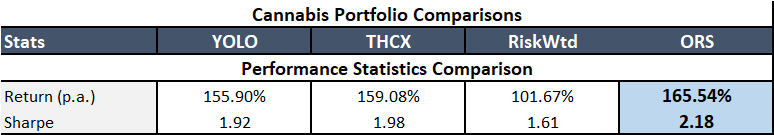

3 – Improved Performance

Next, we look at our backtested performance to understand the tradeoff of using the Risk Weighted approach

While the volatility is much lower, so were the returns. That means the basic Risk Weighting reduced exposure to the Analyst scores AND sacrificed more than a third of the ETF returns.

This dramatic reduction in returns yielded a much lower Sharpe ratio than the basic ETFs.

The illustration of the backtested returns below tells the story clearly. The Risk Weighted portfolio offered much lower vol but sacrificed a huge portion of the returns.

The ORS portfolio’s performance was much more in line with the higher risk thematic ETFs. The systematic Cannabis portfolio even managed slightly higher returns during this period.

ORS delivered increased returns on lower risk, giving a higher Sharpe (2.2 vs 1.9) when compared to the ETFs.

The risk-mitigated ORS portfolio gave investors more exposure to their views, full exposure to the upside in the Cannabis theme and superior risk control. In short, the systematic thematic approach helps construct a more investable product.

Summary

As this systematic Cannabis portfolio thematic example illustrates, a systematic portfolio construction process can help investors create thematic portfolios that deliver more of the risk they want and less of the risk they don’t. This can make highly volatile emerging themes like Cannabis more investable than traditional thematic products.

Systematic portfolio construction methods can offer investors a scalable alternative to thematic investing. To learn more about how to build better thematic portfolios using systematic methods, get in touch with the Sherpa team below.

Summary fact sheet can be downloaded here.

To discuss ORS Systematic Thematics or learn more about Sherpa Funds Technology’s process-driven approach to portfolio construction, get in touch here or sign up for the SFT mailing list.