by Steven Quimby | Mar 25, 2025 | Portfolio Construction, Process Alpha

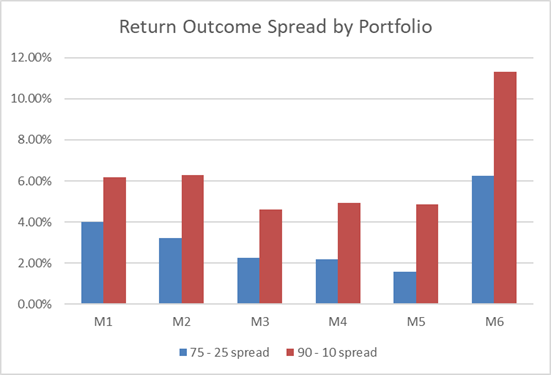

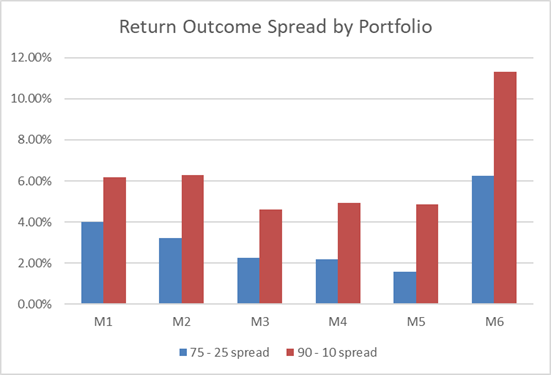

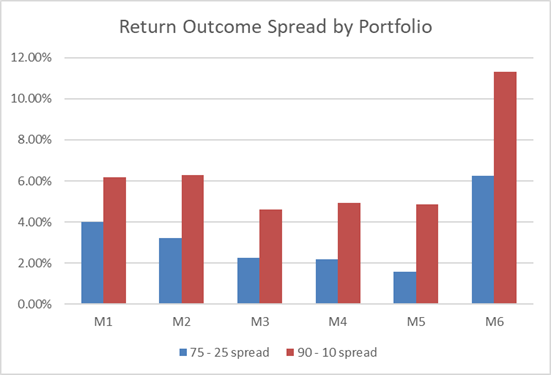

The Impact of Portfolio Constraints Summary: Very few fund managers really understand the impact of portfolio constraints on their ultimate results. While they spend a great deal of time and analytical effort on understanding their alpha ideas, comparatively little is...

by Steven Quimby | Nov 19, 2024 | Portfolio Construction, Process Alpha

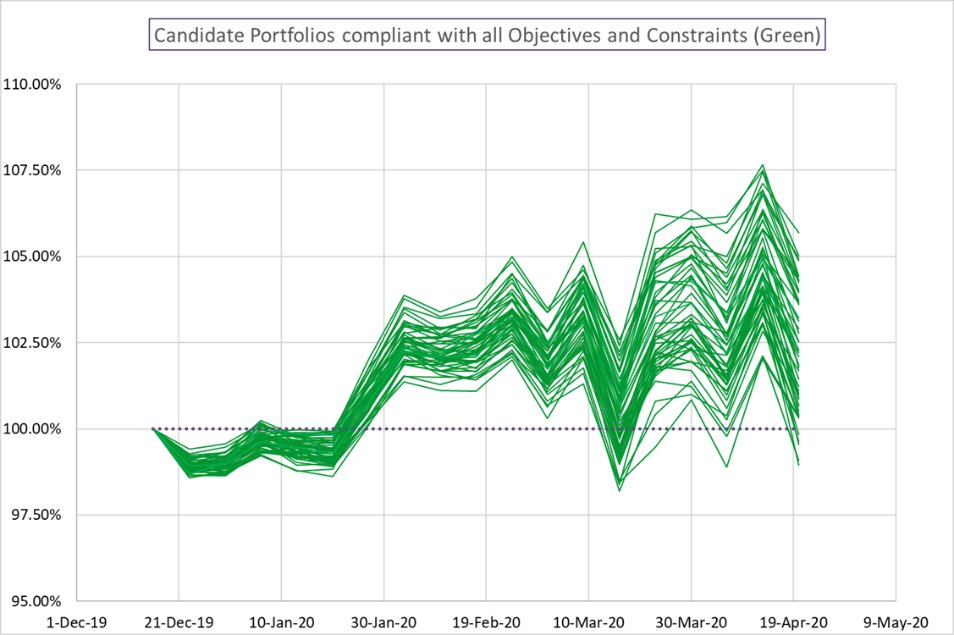

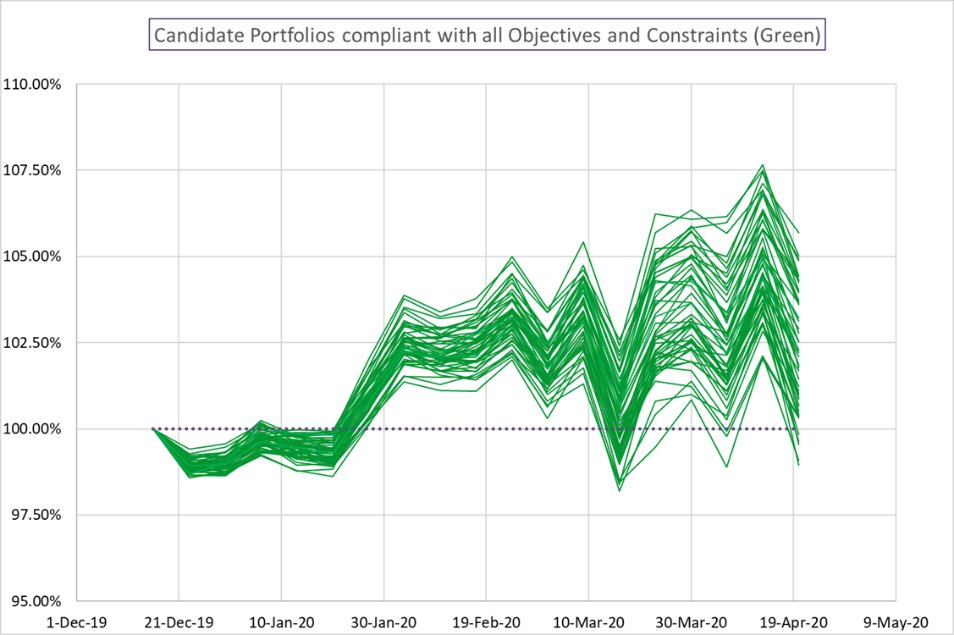

SFT’s Candidate Portfolio Analysis Summary: Fund managers often have an incomplete view of the key drivers of P&L in their portfolio. As a result it is difficult to pinpoint what they’re good at and where they can improve. Sherpa Funds Tech created the...

by Steven Quimby | Oct 8, 2024 | Asset Management, Portfolio Construction, Process Alpha

The 3 Cs for Setting Portfolio Constraints Summary: Many fund managers have bad experiences using systematic portfolio construction tools because they ask the wrong question. Without a well-defined portfolio construction problem definition they end up with a...

by Steven Quimby | Sep 23, 2024 | Asset Management, Equities, Portfolio Construction, Uncategorized

Process Alpha Videos Archive The Sherpa team regularly hosts webinars, seminars and speaks at industry events on portfolio construction topics. You can also find our Process Alpha videos on the Sherpa Funds Tech Process Alpha YouTube channel. Subscribe to our channel...

by Steven Quimby | May 3, 2024 | Equities, ORS Systematic Thematics

ORS Systematic Cannabis Portfolio Summary: Systematic portfolio construction techniques can help institutional investors build better thematic investment portfolios. In this example we create a long-only systematic Cannabis portfolio using the Sherpa’s...

by Steven Quimby | Feb 21, 2024 | Portfolio Construction, Process Alpha, Risk Management

A Better Way to Look at Portfolios Summary: Fund managers lack quality tools to visualize their portfolio and understand its key drivers. Sherpa Funds Tech created the Risk Quality Graph as a tool to help managers understand simplify complex portfolio construction by...

by Steven Quimby | Feb 5, 2024 | Asset Management, ORS Systematic Thematics, Portfolio Construction

ORS Systematic Robotics Portfolio Summary: Systematic portfolio construction techniques can help institutional investors build better thematic investment portfolios. In this example we create a long-only Robotics portfolio using the Sherpa Systematic Process and...

by Steven Quimby | Feb 5, 2024 | Asset Management, ORS Systematic Thematics, Portfolio Construction

Thematic Investing Opportunities Thematic investing strategies continue to grow in popularity, with increasing attention, fund launches and assets under management. In the US, thematic ETFs saw $615mn inflows in Q3 2019 against $756mn in outflows. Singapore, Sherpa’s...

by Steven Quimby | Feb 4, 2024 | Portfolio Construction, Process Alpha

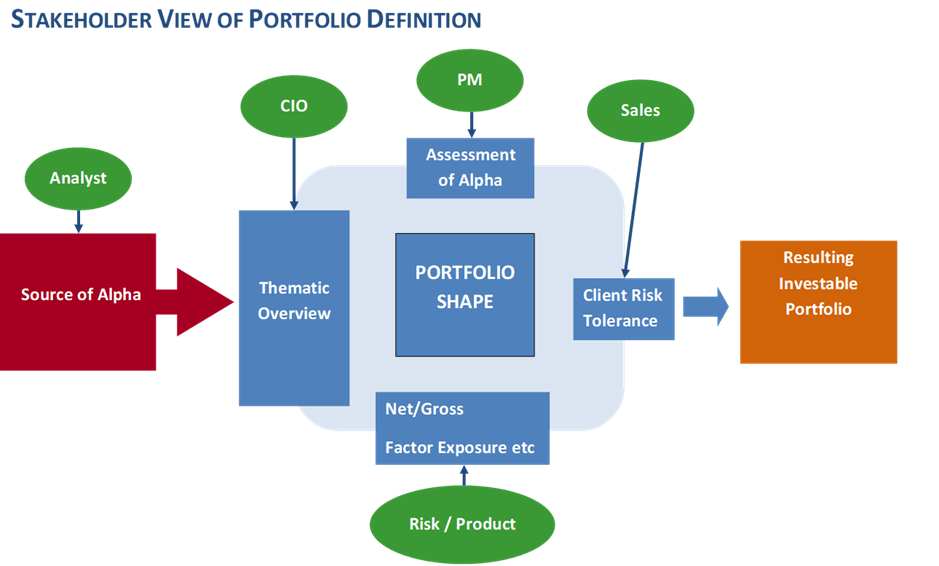

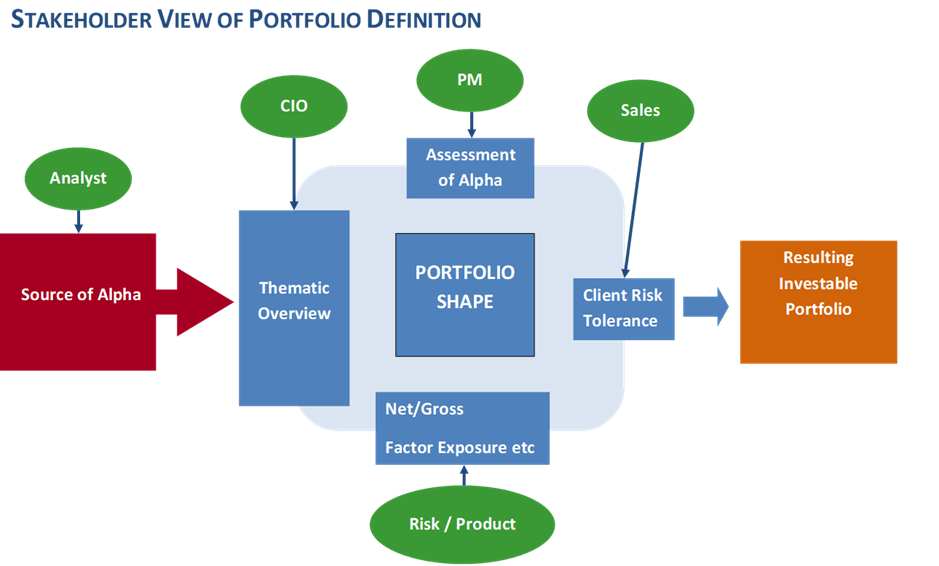

The Right Portfolio Construction Questions Summary: Fund managers can benefit from consistently asking the right questions in their portfolio construction process. A coherent understanding of both how the investment ideas are generated and the desired shape of the...

by Steven Quimby | Oct 24, 2023 | Portfolio Construction, Process Alpha, SFT Updates

Announcing Sherpa’s New Website Sherpa Funds Technology is excited to announce the launch of our updated website at www.sherpafundstech.com. This new site represents one part of our commitment to providing value to global fund management clients over both the web and...