Have You Considered Running a Center Book?

Multi-manager and multi-analyst fund management organizations generate a huge amount of asset selection information with the potential to add alpha to the firm, but few truly maximize the value of that information in the portfolios they construct. Relatively few such organizations deploy a Center Book strategy to better capture the alpha in the information the organization generates.

Multi-strategy equity funds and asset owners allocating to many managers seek to combine multiple teams running relatively uncorrelated strategies.

However, a simple approach can leave alpha on the table due to strategy-level risk limits or produce unintended risks due to overlapping bets.

Many of the largest hedge funds (think P72, Citadel, etc) address these shortcomings by running Center Book strategies.

Ok… But What is a Center Book?

Center Book strategies are typically operated by senior management at large multi-manager funds ‘on top’ of the underlying fund managers’ books. A traditional strategy might be designed to increase the overall fund’s exposure to the best ideas from the underlying managers beyond what they choose to do on their own.

Traditionally such strategies are run by a firm’s senior investment leadership, sometimes working with their Chief Risk Officer or quantitative investment team.

The complexity of implementing Center Book strategies in a risk-controlled manner has historically meant only very large multi-strategy hedge funds successfully run these strategies.

More Investment Organizations Can Benefit from Center Books

Organizations ranging from smaller multi-manager hedge funds, multi-manager long-only asset managers and even real-money investors such as pensions and sovereign wealth funds can also benefit from Center Book type-strategies.

Fund managers increasingly have centralized access to real-time positioning, price targets and more, across all of their internal strategies. And large institutional allocators such as pensions, sovereigns or Super funds now have access to more of this type of data from their external managers.

A Center Book strategy is a way for the organization to apply all of this information at the level of the organization’s combined fund (ie master fund, pension trust fund, etc) while still leaving individual managers free to run their strategy as they see fit.

In this manner, Center Books have the potential to help a wider range of investment organizations maximize the alpha captured from their organization’s information in a way that is more consistent with their overall risk tolerance and objectives.

Questions to Consider When Thinking about a Center Book

These types of strategies are by their very definition not one-size-fits-all. The information, objectives and capabilities unique to your investment organization should drive the design of a Center Book strategy to meet your goals.

A few questions to ask when thinking about whether this might be a useful approach for your organization to consider:

- “Are our individual portfolio managers taking enough risk in their best ideas?”

- “At the whole business level, does our combined portfolio truly reflect our PM / analyst views?”

- “Could we be efficiently deploying more capital against our alpha-ideas?”

- “Should our organization‘s portfolio reflect CIO / investment committee / risk / quant views beyond what individual PM’s choose to implement? “

- “Do overlapping positions in multiple portfolios produce unintended risks that we’re not comfortable with?”

- “Have we realized our desired risk exposures with a simple combination of portfolios?

A Particularly Important (and Tricky) Question

There tend to be many organizational hurdles when first approaching the idea of a Center Book strategy, though generally they can be overcome with a thoughtful approach.

However one question every organization struggles with is – Who ultimately ‘owns’ the strategy in terms of PnL responsibility?

Often this is the Chief Investment Officer though depending on the structure of the firm it may be someone else (Head of Equities, CRO, etc).

We won’t dwell on this question or other hurdles here – maybe a topic for a future blog! – but these are important considerations that need to be considered before embarking down this path.

Three Key Center Book Objectives: Conviction, Liquidity, Risk

Different organizations will have different priorities for a possible Center Book based on their answers to those types of questions.

For simplicity’s sake, let’s say that there are three major flavours of Center Book strategy:

- Conviction Maximiser

- Liquidity User

- Risk Overlay

Any particular Center Book will likely combine these flavours to varying degrees. But in practice each represents a different set of priorities in constructing the Center Book portfolio.

Conviction Maximiser – Topping Up Under-Expressed Ideas

A Conviction Maximiser Center Book focuses on ‘topping up’ their PM’s best ideas to get more exposure to the individual managers’ underused asset selection convictions. This is what most people think about when they hear the word Center Book – a ‘best ideas’-type strategy.

These strategies can be useful because PMs are frequently unwilling or unable to fully back their convictions. This may be due to portfolio-level risk limits, constraints or the PM’s risk tolerance. Such limitations might make sense for the organization (eg. Millennium’s infamous PM drawdown limits) but this means convictions aren’t fully expressed.

By running a Conviction Maximising Center Book, senior managementsingapore can top up positions where it feels the alpha in a PM’s best ideas should be more strongly expressed. This lets them retain whatever portfolio-level limitations (i.e. Millennium example) or PM autonomy that cause under-utilized convictions while still capturing full value from that information.

Liquidity User – Using More of the Market

A Liquidity User Center Book focuses on utilizing more of the available market liquidity in the underlying assets the organization owns to maximize exposure to their alpha. These strategies make sense for organizations with large amounts of capital to deploy.

While individual portfolio managers often run into liquidity limits on specific positions (say small cap stocks, lightly traded assets, or tickers where they’re already a top holder), many positions in more liquid instruments could be much larger across the whole business without undue market impact.

By running a Liquidity User Center Book, management can use this excess liquidity across their fund managers’ ideas to broadly increase capital deployment based on the underlying fundamental alpha. Doing this lets the firm capture more value from the same ‘amount’ of alpha.

Risk Overlay – Controlling Fund-Level Risk

A Risk Overlay Center Book focuses on constructing a portfolio that explicitly mitigates or increases particular risk exposure that the organization wants to control, such as style or macro factors.

The fundamental theory behind most multi-manager funds is that combining differentiated strategies will reduce risk. However, a simple combination of multiple different portfolios may leave unintended or undesirable residual risks.

By running a Risk Overlay Center Book, management can better bring the desired risk of the multi-manager group in line with their organizational objectives using management-level information and preferences. For instance, a multi-manager fund may choose to minimize all factor risks to maximize their specific risk to better appeal to consultant-driven investors.

Center Books In Practice – 2 Real Examples

Sherpa Funds Technology works with funds to improve their portfolio construction to capture more of the alpha generated in their research process. This includes constructing systematic ‘Center Book’ strategies for multi-manager organizations.

To see how these strategies work let’s look at two examples of Center Books leveraging real Sherpa client data:

- Liquidity User Center Book for a long-only global equity institution

- Conviction Maximiser Center Book for a long/short Asian equity hedge fund

Example #1 – Global Equity Long-Only Center Book

Let’s look at an example of a Center Book project Sherpa has been working on with a large multi-manager long-only active equity organization.

This particular manager has:

- 5 portfolios with different mandates owning ~500 stocks over the sample period

- Total AUM of >$25bn USD

- At any time, the organization has 200-250 stocks in these 5 portfolios (some overlap)

- Information is currently only applied at the individual portfolio level; no Center Book strategy (hence this project exploring the concept!)

What Relevant Information Does the Organization Want to Use?

Further, this set of portfolios reflects just one part of the asset manager’s overall business. The organization has internal teams of experts in quant, risk, trading and other functions that help to inform their portfolio managers but might not be full incorporated into their portfolios.

We can group these different sources of information as follows:

- Portfolio managers work with analysts to generate stock selection information (selection + conviction scoring) that the organization believes to have alpha over time

- Management & Sherpa data shows the organization’s PMs generate consistent positive alpha in their largest, high conviction ideas, but have consistent NEGATIVE alpha in their small positions.

- Quant team & Sherpa information shows the organization’s PMs have a consistent positive growth bias and other meaningful residual factor risks

- Trading team information shows that while some of the organizations positions are severely limited w.r.t. liquidity, many other positions have ample liquidity to take larger positions

- The Business has excess capital to deploy

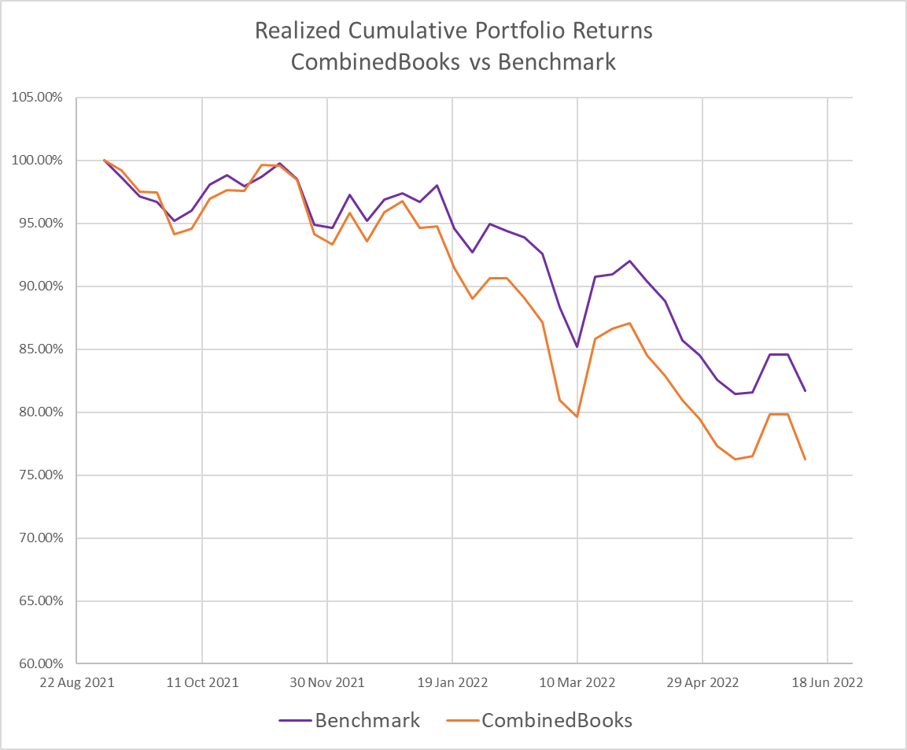

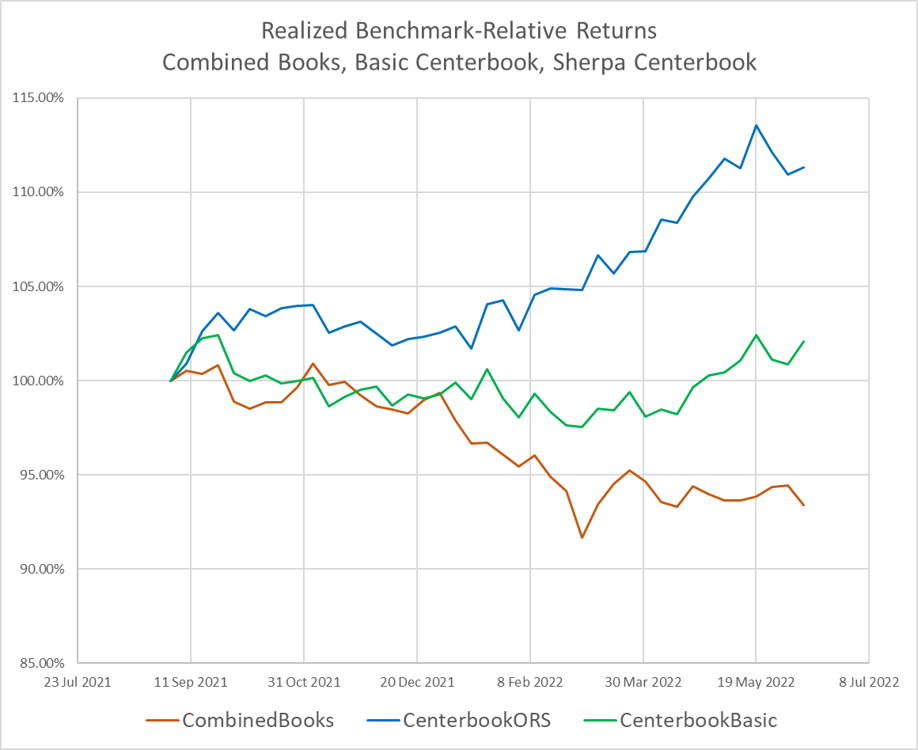

Their Simple Combination of the 5 Portfolios Trailed Benchmark

First let’s look at a simple combination of the 5 portfolios – not Center Book, just what the PMs did on their own. From Aug 2021 to June 2022 the simple combination has trailed its benchmark.

Unsurprisingly to management, the known +Growth bias and the known negative performance of smaller positions have acted as a drag on performance.

Can Management + Sherpa use the Info for a Center Book?

Despite the under performance in this particular period, the organization is confident in their underlying alpha generation process. The question is then how can they better capture this alpha using a Center Book-type approach?

Given the organization’s excess capital to deploy, we created a simple Center Book deploying excess capital ($4bn) to leverage the organization’s information.

The strategy is designed to:

- Better use PM convictions (i.e. more in ‘best ideas’ excluding small low conviction names)

- Group stocks by conviction from 1 = lowest to 4 = highest

- Remove the lowest conviction group of stocks

- Drops the on avg ~225 stocks at any given time to ~105 higher conviction stocks

- Better use available liquidity

- Take advantage of unused limits on ownership and trading volumes on each asset in the selection

- Set Business level limit on ownership of a company to 5% of market cap

- Set Business level limit on daily trading volume to 33% of 90d ADTV

Let’s first look at what happens if we simply build a portfolio with stocks above sized to take a proportional amount of the available liquidity

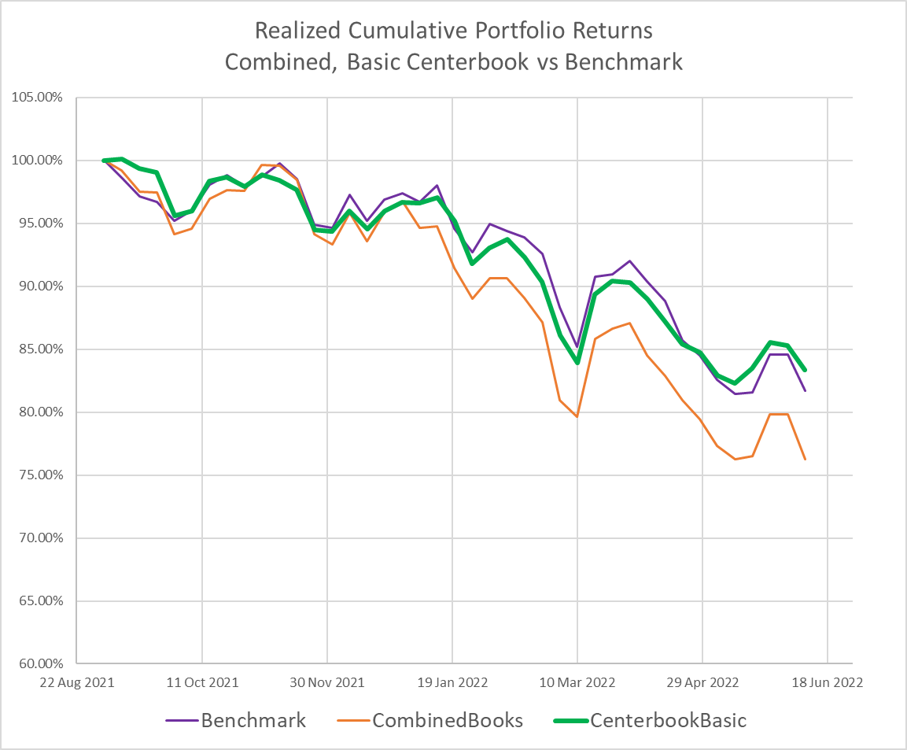

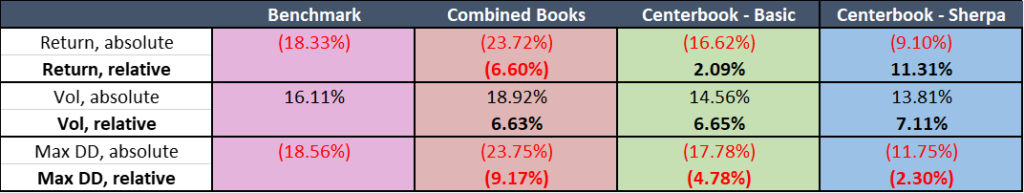

Step 1: The ‘Basic’ Center Book Is a Meaningful Improvement

Our ‘basic’ Center Book outperforms the benchmark index with lower volatility and drawdown.

Applying more of the organization’s information adds significant value in terms of both higher returns AND improved risk. Intuitively this makes sense – the conviction filter removes most of the smaller positions the organization’s information suggests are detracting from returns.

But can we do better with the same info?

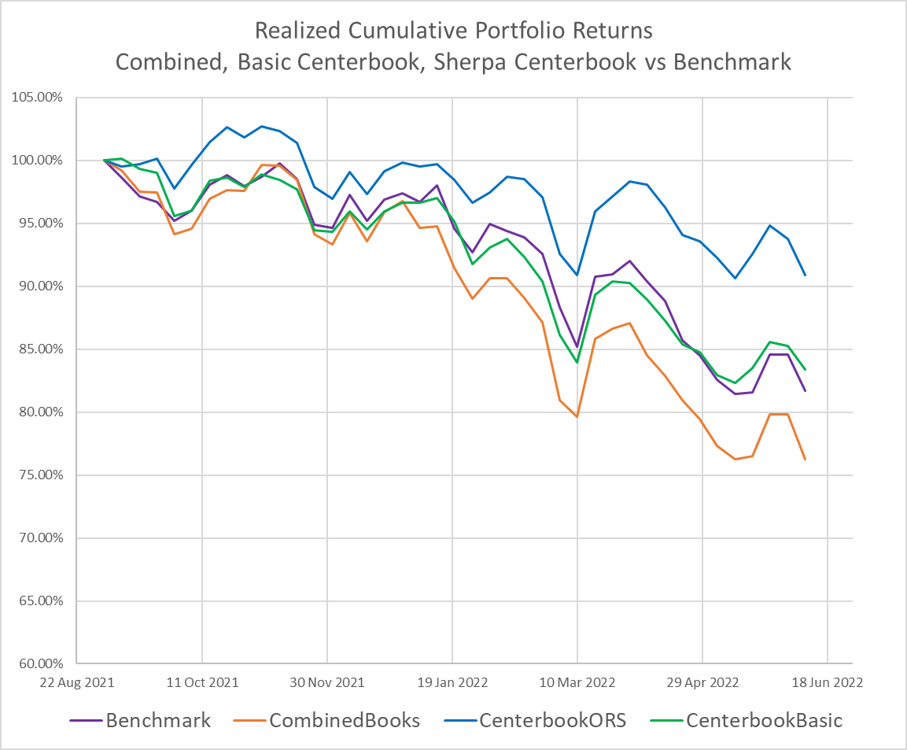

Step 2: Apply Good Portfolio Construction Process

Next we further developed the strategy by leveraging our ‘Optimal Risk Sizing’ process. Here we used systematic portfolio techniques using the same set of higher conviction stocks and liquidity constraints to maximize the alpha extracted from the organization’s information.

There is no new Analysis or PM work involved: This capital is deployed using ALL of the Business’ information and objectives, and Sherpa’s systematic Portfolio Construction process to drive construction and sizing.

In Both Cases, The Center Book Improves Results From the Org’s Information

The simple combination of the 5 PM’s portfolios lagged the benchmark largely for the reasons the organization knew of ex-ante (growth factor + poor asset selection in small positions).

The Center Book offered a way for the organization to leverage the fundamental stock selection alpha combined with information from management, quants and trading to realize MUCH more value from the alpha and deploy excess capital.

But… Why are the Center Books Such an Improvement?

Shown in relative-return space the difference is even more stark.

Beyond the known factor / small position issues, why are the return streams so different between these three portfolios?

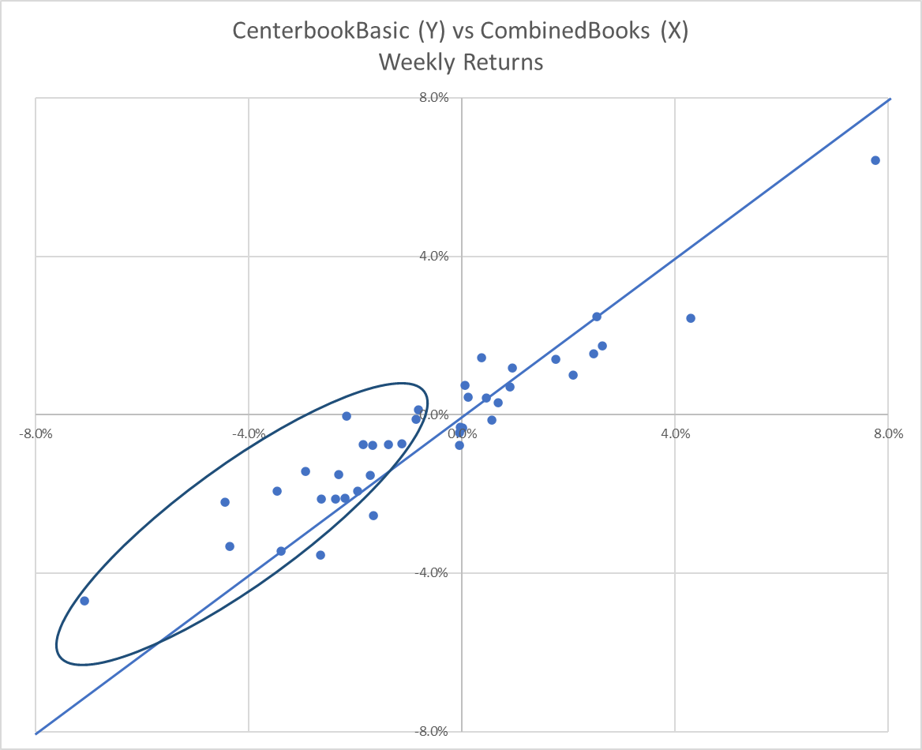

Compare Weekly Returns of the Combined and Basic Center Book

In the following chart we compare the weekly returns of the simple Combined Portfolios on the X axis with the ‘Basic’ step 1 Center Book on the Y axis. This shows us WHEN the Center Book approach improved returns.

In weeks when the Combined Portfolio lost money, the ‘Basic’ Center Book almost uniformly lost less.

In 75% of the weeks in which the Combined Portfolio was down the ‘Basic Book’ lost less, and it never lost meaningfully more.

The Center Book approach was much lower Vol on the downside – so not only did this approach better use convictions and liquidity, it had a more favorable risk profile as well!

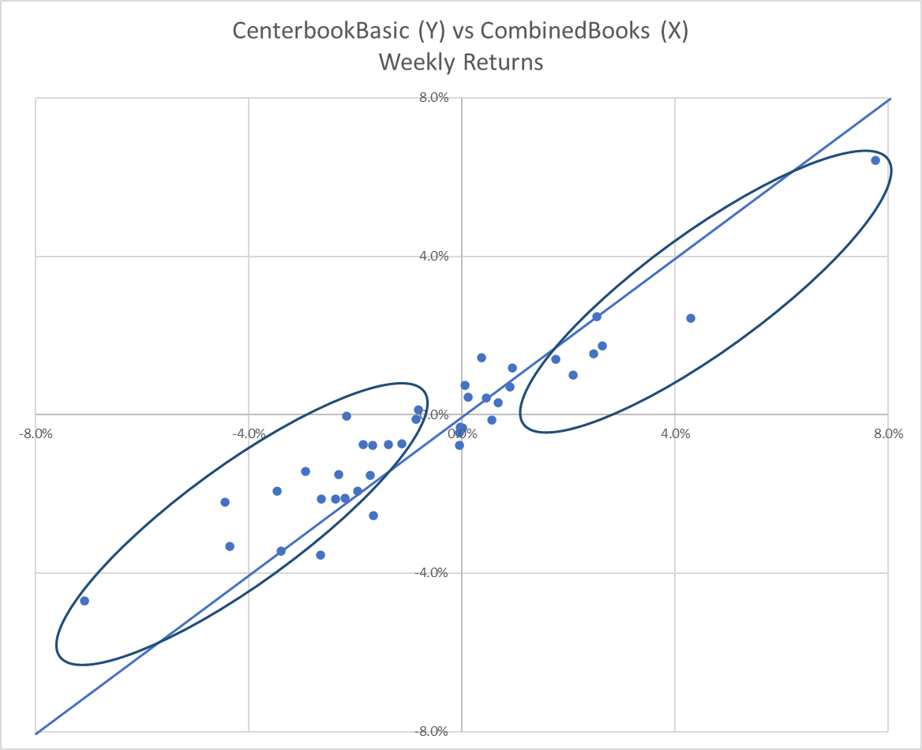

However, the Lower Vol was Unfortunately Symmetrical

However, the ‘Basic’ Center Book largely trailed the Combined Portfolios in periods when the Combined were up.

So, while this Basic Center Book limited downside, it had fewer very strong periods – the risk reduction was largely symmetrical.

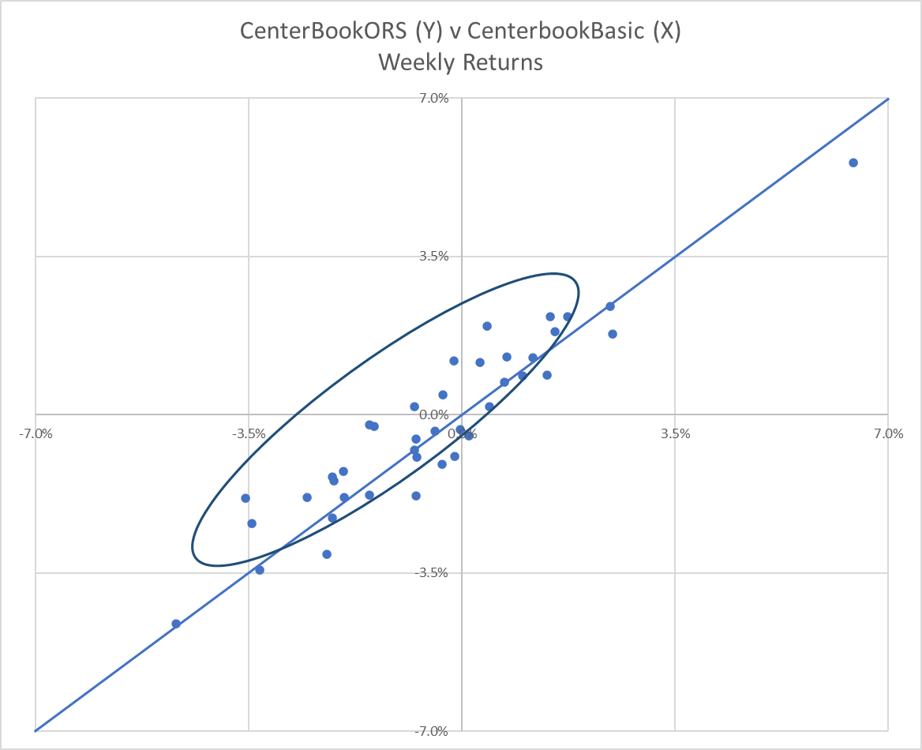

Comparing the ORS and Basic Center Books Shows The Opportunity

Let’s use this same lens to compare the ‘Basic’ and ‘ORS’ Center Book strategies.

Again the ‘well-constructed’ systematic Sherpa ORS Center Book is even a bit better than the Basic book when the portfolio overall is down – a benefit for a downside-risk-focused systematic construction process

However, the ORS portfolio maintains exposure to the underlying alpha in such a way that it doesn’t trail when the portfolio is up!

The result is even lower downside risk (lower drawdown) and higher returns.

Center Book Example #1 Takeaways

- The same info that manages the $25bn in the main books

- Combined with Business Objectives and a good portfolio construction process

- Can be used to manage a further $4bn

- Within market Liquidity constraints

- To generate significantly improved results in both risk and return terms

Example #2 – Asian Equity Long/Short Client ‘Live’ Center Book

Our second example of a Center Book is one that has been ‘live’ for an Asian long/short equity multi-manager client fund of Sherpa from 2021 to present:

- 2 portfolios with very different styles owning ~200 stocks over the sample period

- Total AUM of >$200mn USD

- At any time, the organization has 100-120 stocks in these 2 portfolios (some overlap)

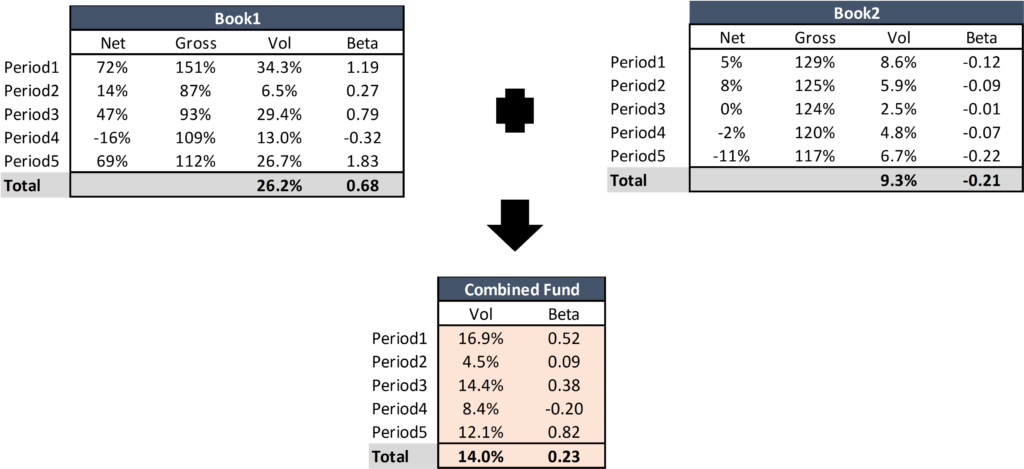

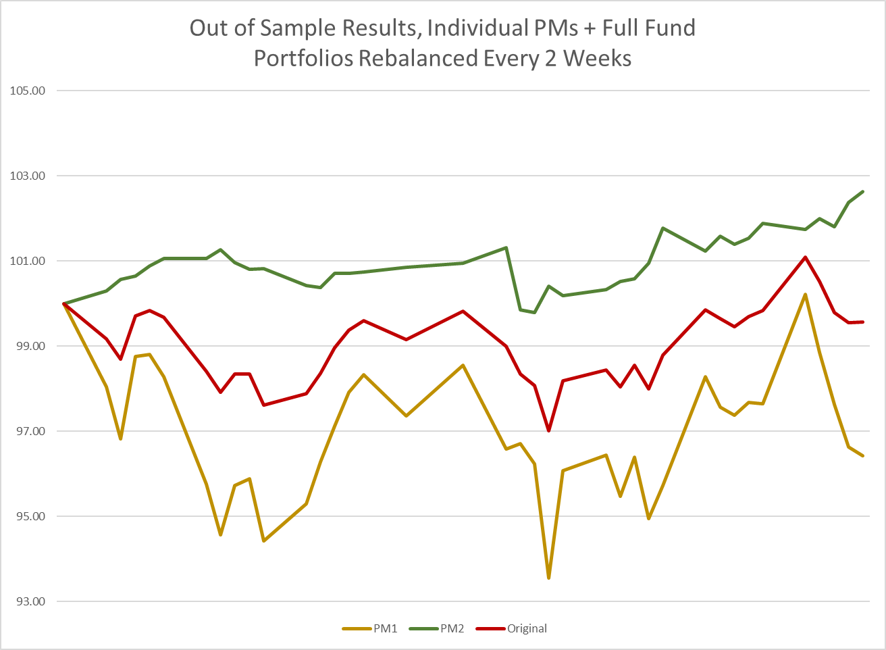

HF XXX has Two Different PMs Running Very Different Books

Book1 is very directional and has historically very high realized volatility. The PM takes large bets and big directional risks.

Book2 is a more traditional fundamental market neutral strategy and is run on a much lower vol.

A simple combination of these two portfolios means risk and returns of Book1 have dominated the master fund’s results in the past.

On the other hand, Book2 has produced consistent results – generating strong alpha with a good Sharpe – but the pod’s PM isn’t comfortable running more risk and larger positions.

The CIO’s question to Sherpa was direct:

- “Can I create a Center Book strategy that gives me more exposure – both bigger individual positions and higher Gross – to the alpha being generated by PM 2 without increasing risk / downside vol at the master fund level?”

In terms above, this meant creating a Conviction Maximiser style Center Book to more aggressively express PM 2’s convictions without interfering with their process, AND in a way that is aware of PM 1’s positioning to control overall fund risk.

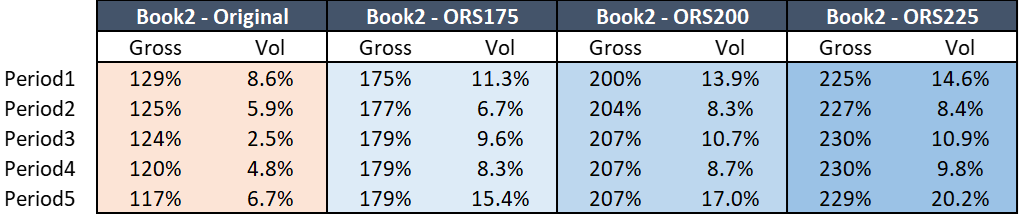

Increasing Exposure to Alpha in Book 2 Increases Book Level Risk…

We use the same Optimal Risk Sizing tech discussed above to create 3 different Center Books that increase the Gross exposure to the ideas in Book 2 to 175% / 200% / 225%. Unsurprisingly this increased the volatility of the Center Book-driven Book2 portfolio due to the increased leverage.

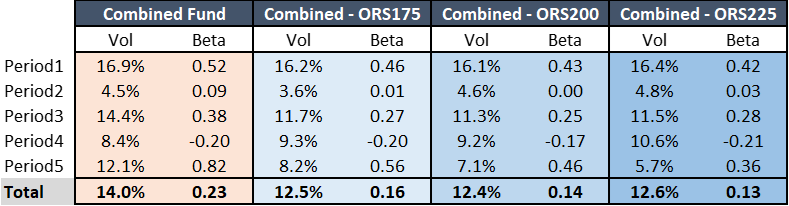

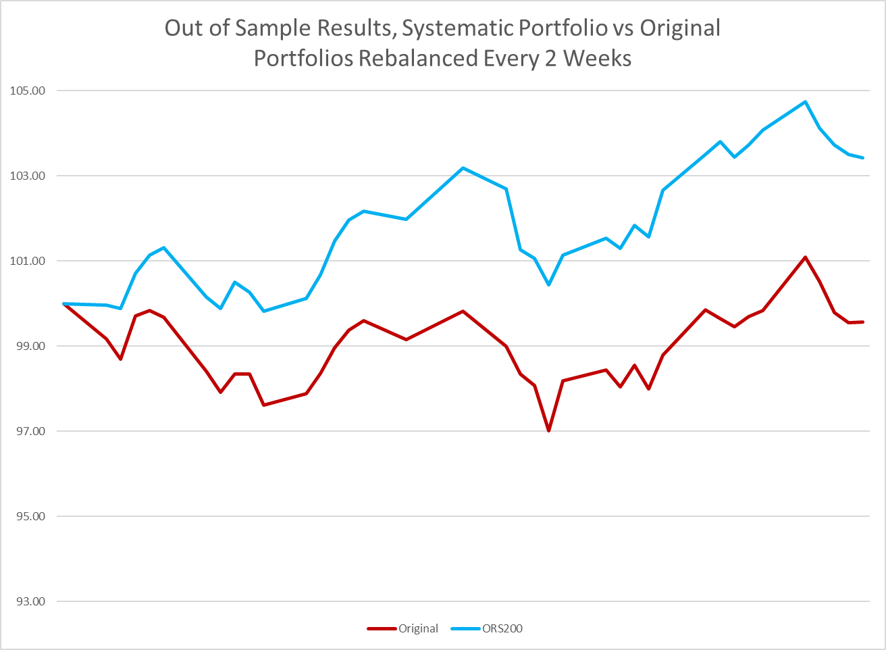

… But Done Properly It Reduced Fund-Level Risk and Beta vs Mkt

A well-constructed set of systematic Center Books let the CIO increase exposure to the alpha the team generates while retaining the same / lower level of downside vol and reduced directional market risk.

The result – the fund gets more upside returns from the fund’s research alpha without increasing risk at the fund-level!

This Yielded +300bps Return in 3m During 2021 with Lower Realized Risk

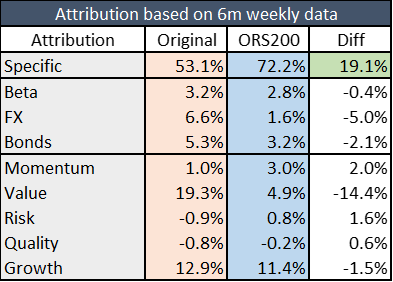

The Center Book Portfolio Takes More of the Risk Investors Want

Additionally, the systematic ORS Center Book portfolios’ returns are driven much more by stock specific risk.

This increases the link between research alpha and fund returns, while making the fund more investable to consultant-driven and institutional investors.

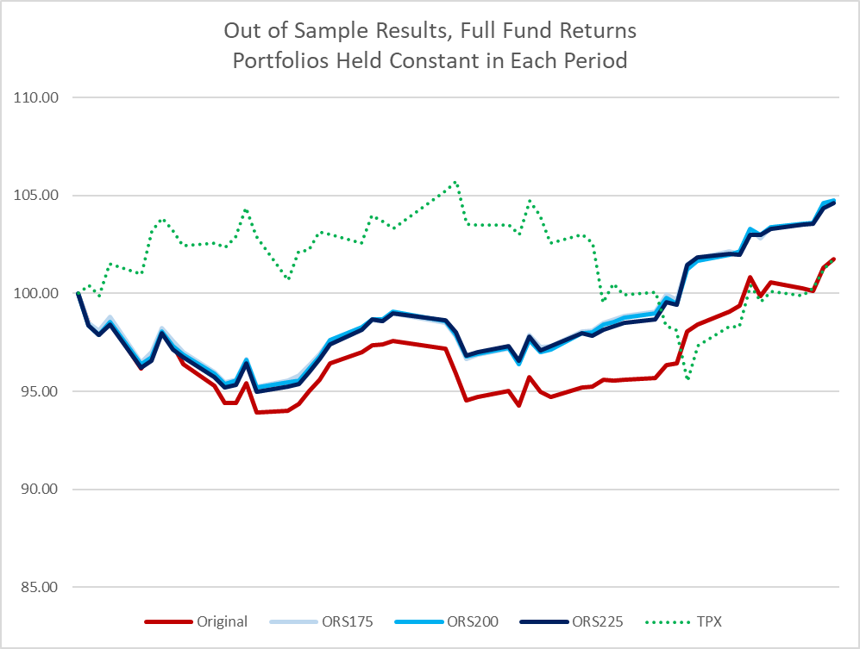

We Can See the Same Dynamic During Higher Market Vol in 2022

Looking at the realized ex-post results during a tough market in early 2022 we can see the same story play out. Book1 (YELLOW) displayed very high volatility and some steep drawdowns and rallies, while Book2 (GREEN) posted steady positive returns on low vol.

But a simple combination of the two ‘as-is’ looks much more like Book1 in terms of both risk and return than the steady compounding Book2.

And again a systematic Center Book approach helped the CIO extract more returns from his team’s fundamental alpha generation in a risk-controlled way.

The ORS portfolio maintained very similar volatility and drawdown levels as the simple combination, but captured more returns from the Book2 PM’s fundamental alpha.

Good Center Book Strategies Add a Lot of Value

These examples show two very different organizations with two very different styles / strategies and very different priorities in terms of building a Center Book.

But both tell the same story – the results of simply combining your portfolios does not capture as much value from your organization’s hard-won alpha generation as you could with a Center Book strategy.

Whether your priorities are more towards a Conviction Maximiser, Liquidity User or Risk Overlay, in each case a Center Book can help better meet those objectives by better leveraging all of the organization’s information.

Should Your Organization think About a Center Book?

In short, Sherpa believes many more organizations should consider whether they might be able to implement a Center Book strategy. While most think of these as the exclusive preserve of large, sophisticated multi-strategy hedge funds in practice the technology and process required to do this are more accessible than you think.

- Most multi-manager investment organizations can benefit from a Center Book strategy, not just very large hedge funds

- Different organizations have different priorities in Center Books – Conviction, Liquidity or Risk are three typical examples

- A systematic portfolio construction process like what we implement at Sherpa can help your organization create a Center Book strategy to maximize the value from your information

- There are organizational hurdles to overcome, but they are not show-stoppers.

To see our video presentation on Center Books, check the Sherpa YouTube video here or to read more about Why (Good) Portfolio Construction Matters, check our blog link here.