In the world of Asset Management, the Portfolio Manager is King. I write ‘King’ as it remains a profession dominated by men: according to Morningstar, 86% of portfolio managers in 2021 were men, a proportion that has remained unchanged for 20 years.

This blog is not about the inherent gender-inequality in the profession, rather it is a look at what these Kings do – what they are good at and perhaps, not-so-good at.

Setting up what a King does

One thing about being a ‘King’ is that you are quite exposed: the buck stops with you, and the decisions you have to take, will cover all aspects of ‘kingdom management’, from the logistics of securing supplies, political manoeuvres to displays of military might. A King might be wonderful as a wartime general but have no training in the day- to- day administration of taxes and building infrastructure.

And we can understand and possibly even sympathise with our unfortunate royal who finds himself deep over his head in one area or a few.

Portfolio manager role

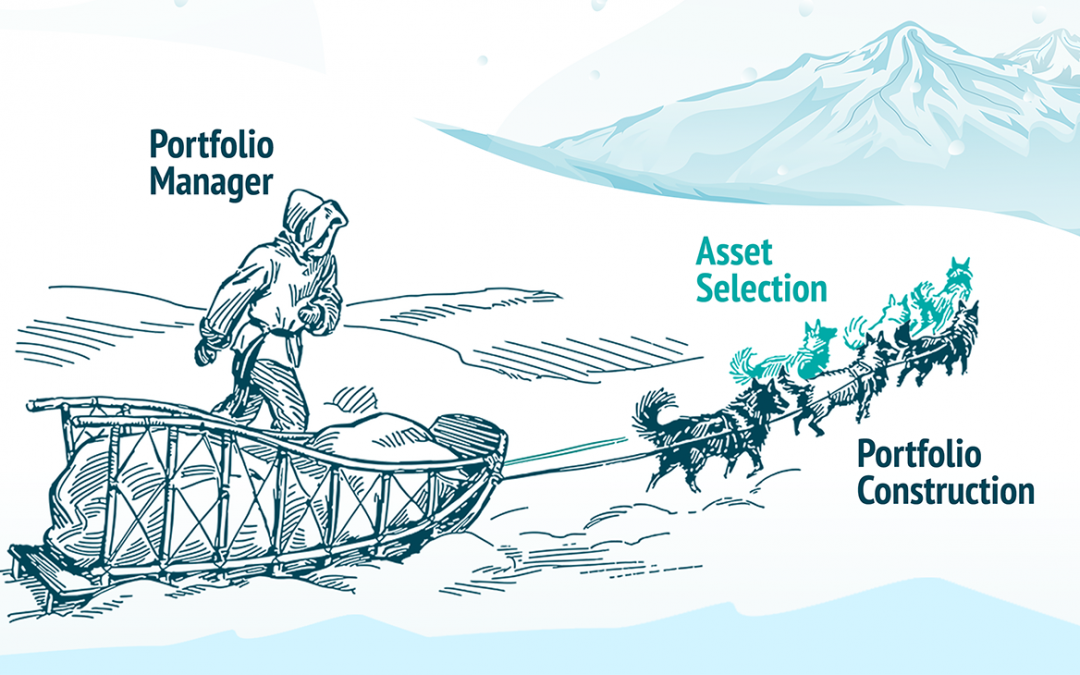

A Portfolio Manager’s (PM) predicament is no different. Most PMs are very well versed in the techniques of Asset selection: from sourcing information, querying veracity, and analysing conflicting reports. Many PMs have been thoroughly trained in the complexities of financial analysis through the excellent CFA program or similar.

PMs have also built-up knowledge and contacts; they have an ability to ‘generate alpha’ – by which we mean that the assets they select to buy will outperform those they leave behind (in the case of Benchmarked managers) or those they sell or use as funding assets.

And when we talk about Asset Managers having skills – it is these skills that we most often talk about: the skills of Asset Selection. Most conversations will be about why the Manager likes Asset X, what thesis they are following, why the market has not priced it correctly, all reasons to take a position on that asset, essentially all the things that Manager’s training has equipped him to do.

Asset Selection vs Portfolio of Assets

However, the end product of a PM’s work is NOT just a selection of assets, but a putting together a PORTFOLIO of assets, that reflect the requirements of various stakeholders, to generate a meaningful return.

And that is a very different thing.

A selection of assets can be described with a paragraph on each asset, with some data, which all explains why the PM likes it.

A portfolio of assets requires that the assets are brought together in such a way as to meet some underlying set of objectives and constraints. There is a necessary set of mathematical conditions that must be satisfied.

(Steven Quimby, our Sales & Marketing Director and I delve into what makes a good portfolio here)

This is the crucial second part of a PMs job – taking the results of the analysis performed, i.e., the set of selected assets, and using these assets to build a portfolio that satisfies all the stakeholders’ objectives and constraints.

Managing a portfolio of assets is a very different skill set from asset selection.

Managing a Portfolio of Assets

Input is clearly defined: the list of assets and the portfolio objectives and constraints (O&C).

Note to the generous reader – getting to the bottom of these O&C is the subject of many other blogs I have written.

Output is numerical and high dimensional (the dimensionality is the number of assets in the portfolio): it is the portfolio weightings of each asset.

Contrast with Asset Selection.

Input is heterogenous and undefinable: the PM can get ideas & data from a huge variety of sources in all formats.

Output is at a per asset level: something like a single number that represents the PM’s conviction on that asset.

Asset Selection uses very human skills – the ability of the human brain to process undefined information combined with CFA-type training allows a PM to come up with asset selections/conviction scores that exhibit alpha.

However, in portfolio construction, taking a set of defined inputs (assets and scores) and performing a calculation to come up with the N-dimensional vector of weights (which defines the portfolio), that factor in the following:

- Expresses the Alpha in the Asset Selection/Convictions

- MinimisesDownside Risk

- Matches the O&Cs

- Has portfolio Risk characteristics in line with mandate and risk appetite

is very much not a human ability. It is a complex mathematical calculation that needs time, energy, proper tools and focus to achieve.

And it is very important.

Our data (200+ portfolios over 7 years of doing this as a business) show that typical Benchmarked Long-Only PMs leave 200-300 bps per annum on the table. That is, their asset selections could drive improved performance with no greater risk to them or stakeholders, to the tune of 200bps pa.

If they are expecting to generate 450bps of alpha (let’s say), and we take the lower estimate, then it tells us that PMs could justify expending 30%+ of their energy on thinking about portfolio construction.

Our experience is that 95% of PM conversations are about the asset selection, and 5% is about portfolio construction. For PMs to perform to their true potential, that ratio would need to change: Portfolio Construction deserves much more of the PM’s time and effort.

Granted you might not want to reduce the time spent on asset selection by 25%, even a 1% increase of time spent on Portfolio Construction would go some way to improving the shape and return of the portfolio – the ultimate goal.