Asset Management and the struggle with innovation

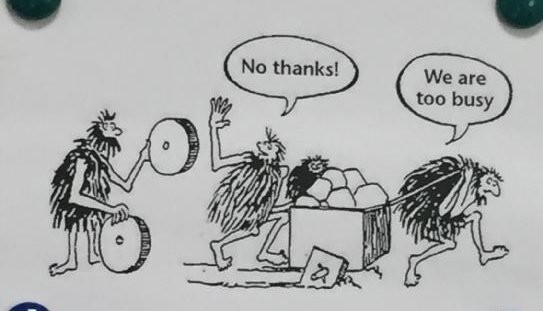

I saw the cartoon above on LinkedIn a while back, and I’ve been thinking about what’s going through the minds of the team dragging the box: not least because they remind me of how it sometimes is when you work in finance.

They know what they’re doing is tough. But they’ve got a delivery to make. And they know what they’re doing will mean that the box is delivered on time, even if it takes some effort.

Then the innovator comes along with a new idea that will make the box go faster. It’s obvious to him that it will. But the guys pulling the box are sceptical.

Here come the questions….

“How does it work”, they ask?

“Will the circular ‘wheel’ fit the axle? Will it break? Do we know how to fix it? Will the supplier be there to help?

If we decide to fit that wheel will we have to stop what for a while to fit it? That’s going to make us lose time. We’ll fall behind in our goals.

After all, we have stakeholders, bosses, employees and clients, you know. These people depend on the box being at the goal at a certain time. We can’t put that in jeopardy.

So I’m afraid we’re going to have to pass.”

How Other Industries get around this

Innovative (i.e. successful) manufacturing businesses often change processes, and do it in a controlled way.

- When a new process looks like it will increase efficiency they set up a small parallel line to test it.

- If it does, they build up the capacity of the parallel line while gradually running down the original line.

A key difference with Asset Managers that manufacturers’ capital comes from shareholders who expect investment in R&D and know that it involves some level of risk: if an innovation does work it can dramatically impact on their bottom line in what is a very low-margin business.

Finance Industry Conservatism

I think there are three reasons finance is much more conservative about process innovation (although not necessarily product innovation!):

- There is very little emphasis on front-office process in the first place. (This is something I’ve written about in the past [Process makes Profits]). The Industry’s focus on individual decision making clouds our judgement on what humans are good at and what’s best left to the machines.

- Although the total ROE in financial services is low, the differential margin attributed to individuals’ decision making is huge. So there’s limited pressure to make decisions more efficiently, and a reluctance to question the way those decisions are made.

- We’re in thrall to the mystique of Fiduciary Duty and use it to justify the status quo. Testing an innovative idea on real money (someone else’s real money) can easily be misinterpreted. Shareholders in other Industries expect their money to be spent on R&D. Investors in Funds are not so keen on this.

So it’s not surprising that innovation is hard, especially in established businesses.

What that means for Asset Managers, Innovators and Investors

As someone who wants to show you the benefits of potentially game-changing technology, my message is NOT just that our clients – Asset Managers – must be more accepting.

But first that the Innovators and the Investors (the end clients of the Asset Manager), must have some dialogue. Unless these clients understand that we are all working for them, they will be nervous, and that nervousness will spread through the chain.

And secondly the Innovator has to show an implementation plan that does not cause disruption to the Asset Manager.

And only finally that the Asset Manager can benefit from controlled process change, and should look more at Innovations like these I wrote about previously.

That’s also why after we demo our software, SherpaORS, we run parallel portfolios for our clients. You get to experience the immediate and real difference it makes to your portfolios with no impact on your daily routine.