Do You Understand Why Portfolio Construction Matters?

Traders often say the right idea at the wrong time is as bad as the wrong idea. Similarly, a poorly constructed portfolio of good ideas can destroy most, or even all, of the alpha in a PM’s stock selection. Despite this, few active discretionary portfolio managers truly understand why portfolio construction matters.

Most active fund managers, and indeed most fund management organizations, are overwhelmingly focused on asset selection. And rightly so – if an active manager doesn’t produce any alpha the rest of the problem might be moot.

Yet while asset selection is undeniably critical in active management, portfolio construction is critical to actually realizing a fund manager’s hard-earned selection alpha.

There are a HUGE number of portfolios a PM COULD build from their selection of stocks and that range of portfolios typically has a HUGE variation in returns. But very few fund managers have a firm grasp on just how large the impact of portfolio construction really is.

One Sherpa client, a billion-plus-AUM long/short equity manager, consistently shows a nearly 4% monthly gap between the best possible portfolio construction using their stocks and the worst. That annualizes to a 50% gap between the best possible results and the worst… from the SAME STOCKS.

Let’s dive in and look at why its very hard to intuitively understand why portfolio construction REALLY matters to your performance.

There’s a HUGE Number of Possible Portfolios From Any Set of Stocks

Say the portfolio consists of 3 stocks – A, B and C. Let’s say each of the stocks can be between 20% and 80% of the portfolio, the sum of the 3 weights must equal 100% and each stock’s weight can vary in increments of 10 bps (ie. 20.00%, 20.10%, 20.20%, etc).

If stock A = 20% then there are 400 different ways of organizing B&C – 400 possible portfolios even holding A constant! If A = 60% there is only one way to organize B&C – 20% and 20%. So there are 400 ways of weighting A with between 400 and 1 ways of organizing B&C, so the approximate number of possible portfolios is 400 x 200 = 80,000.

As you increase the number of stocks the number of possible portfolios becomes very large very fast.

Those Portfolios Can Have HUGE Differences in Returns

Now imagine that in a single period stock A returns 50%, stock B returns 25% and stock C returns 0%.

If we held our portfolio constant during that period the best possible return would be the 60% / 20% / 20% portfolio mentioned above, returning 35%.

The worst possible portfolio would be one that holds 20% / 20% / 60%, returning 15% – or a 20% return difference from the same stocks just based on portfolio construction!

But that gap is very sensitive to the actual realized asset returns and the allowed minimum and maximum sizes. For instance, if returns were say 60% / 15% / -25% the gap increases to 34%; if they were 25% / 15% / 10% the gap is only 6%.

Combining these two basic ideas illustrates why portfolio construction is very important. The number of possible portfolios a PM COULD construct given their set of stock selections is huge… think BILLIONS. And the spread of possible return outcomes from the same stocks can be both very wide and very difficult to intuit.

Good Portfolio Construction Makes a Real Difference

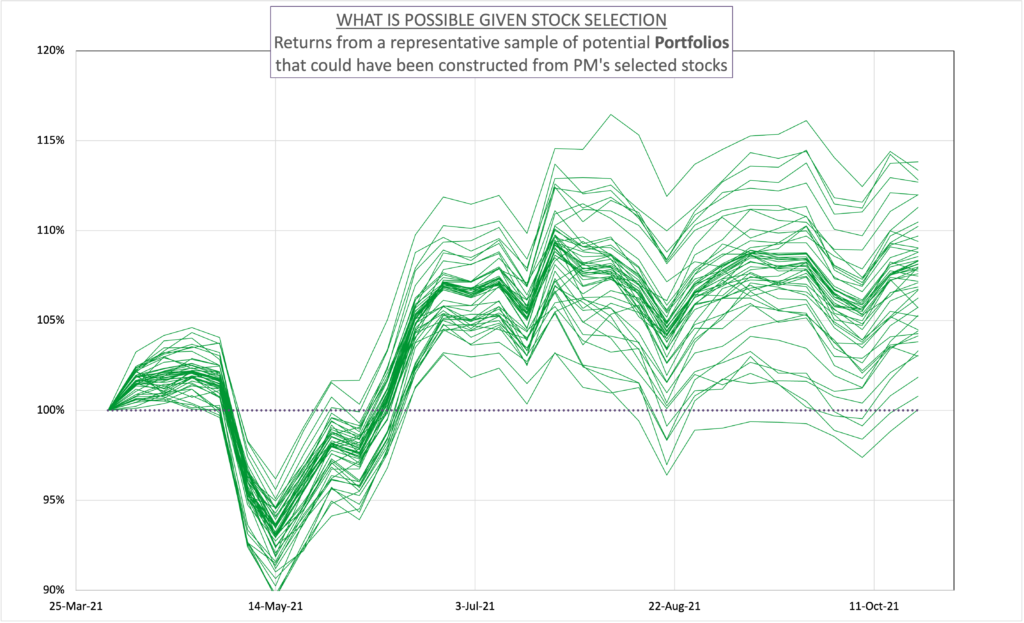

Let’s move from a simple abstract model to a live Sherpa client example. The fund in question is a US global stock fund with a ~$3bn USD AUM.

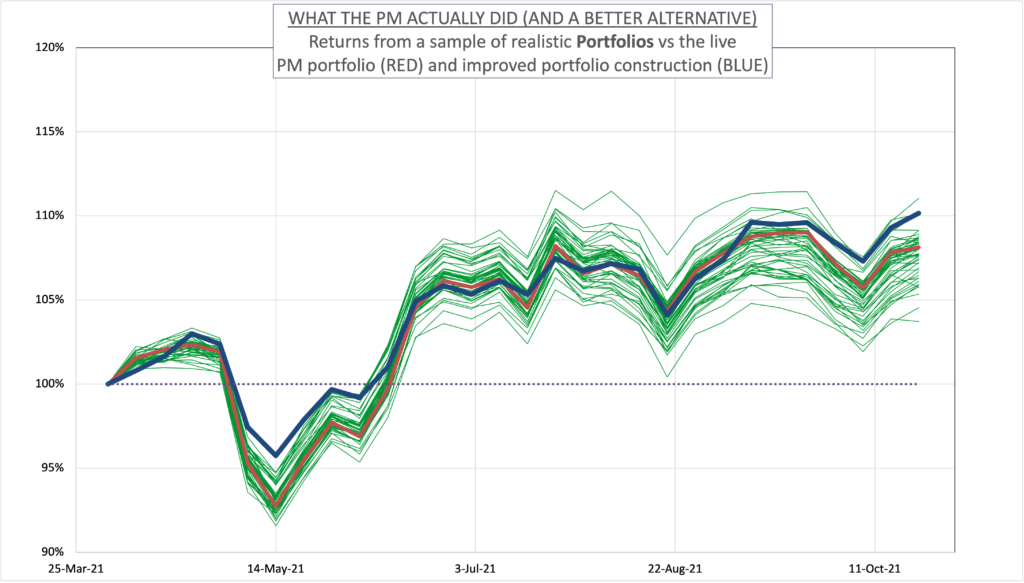

With active position sizes of 50 – 500 bps as mentioned the PM COULD construct billions of different portfolios from his 40 stocks. The green lines show ex-post returns from a representative sample of 50 possible portfolios this PM could construct.

There is a 14% return gap from the best to worst possible constructions in 6 months using the same stock picks!

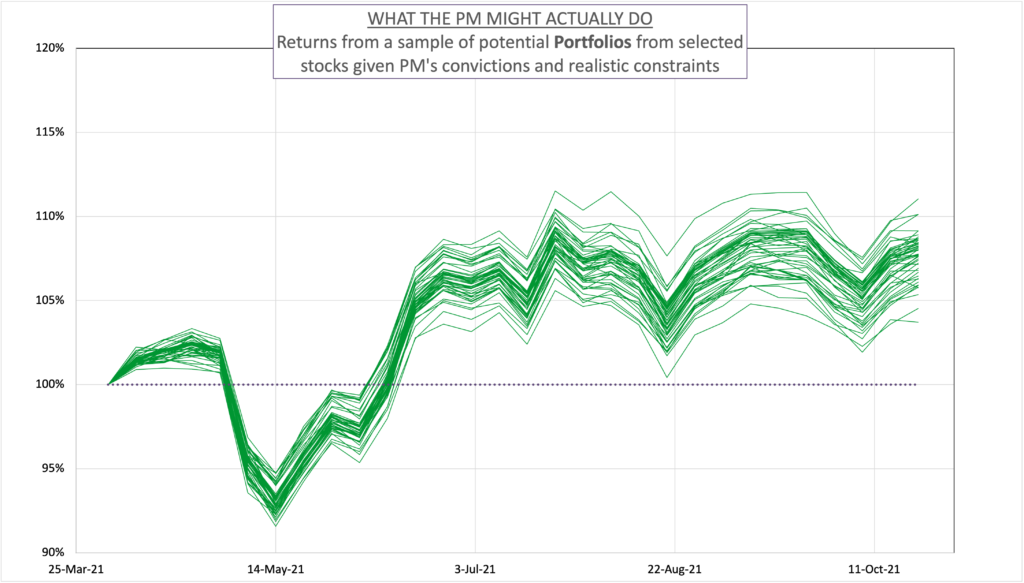

Now, many of those portfolios may not be realistic so let’s refine the sample to show only what the PM might ACTUALLY do.

This subset of the possible portfolios includes position sizing rules designed to reflect the PM’s convictions, as well as constraints on sector and country exposure – +/-6% vs the MSCI World index benchmark.

The spread is narrowed, but there is still a 7.5% gap over 6 months from the best to the worst possible constructions.

Looking at the possible returns here the PM clearly did a good job picking stocks. On average the possible portfolios beat the benchmark by ~7.5% in just 6 months!

But particular poor portfolio construction could have halved the average return or increased it by more than 50%!

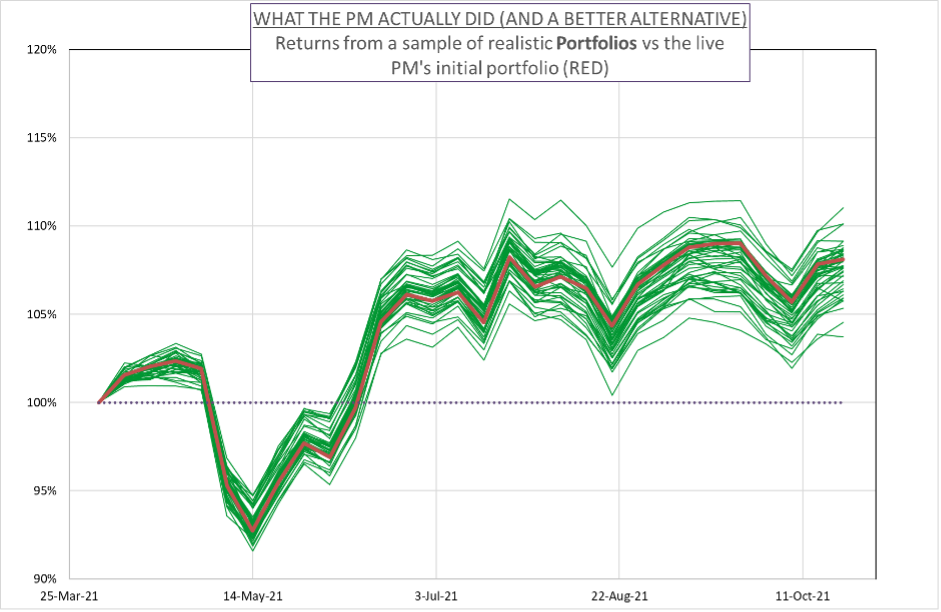

Now look at the RED line – the realized performance of the actual live fund positioning at the end of Q1 2021. The actual portfolio realized an 8.1% return, or the 56th percentile of possible portfolios.

That’s Pretty Good, Right? But What Did It Leave on the Table?

The 90th percentile of possible portfolios returned 10.3% during this period, or 4.4% greater returns on an annualized basis. Or put another way… for a $3bn USD fund that improvement equates to $132mn USD of potential gains. To paraphrase former US Senator Everett Dirksen – ‘a hundred million here, a hundred million there, and pretty soon you’re talking real money.’

No matter how good you are at portfolio construction its unlikely you’ll consistently realize a 90th percentile result. However, Sherpa’s experience working with fundamental PMs shows it IS realistic to move from simply average – like the 56th percentile above – to consistently good, or the 60th-80th percentile of possible returns.

Let’s see what that looks like in this example. The BLUE line is a portfolio constructed to deliver exposure to the PM’s convictions while controlling portfolio-level risk by better accounting for stock CoMovement, factor risks and other undesirable residual risks.

This Sherpa-assisted systematically constructed ‘good’ ORS portfolio returned 9.7% versus the benchmark, moving the PM from the 56th percentile to the 80th – from average to good – adding 150bps in 6 months with lower drawdowns and volatility.

Good Portfolio Construction Matters a LOT, but is Hard to Do

From our experience at Sherpa working with PMs running a wide variety of funds at some of the industry’s leading shops, this example is actually fairly typical. Most experienced PMs without systematic tooling and assistance realize generally around average results with their portfolio construction.

And that makes sense. Very few PMs generate enough selection alpha to be consistently very poor with portfolio construction and keep their jobs! But it is very hard to be consistently excel at the complex mathematical problem of good portfolio construction using the inherently fuzzy human brain.

Portfolio construction has a massive impact on a fund’s realized returns, and consistently building ‘good’ portfolios is a very hard task.

To learn more about how to improve your portfolio construction process, check out a few of our resources at the links here and here.