ORS Systematic Robotics Portfolio

Summary: Systematic portfolio construction techniques can help institutional investors build better thematic investment portfolios. In this example we create a long-only Robotics portfolio using the Sherpa Systematic Process and Optimal Risk Sizing (ORS) maths engine. The resulting portfolio has greater exposure to our analyst’s Alpha scores, better risk-control (lower vol and lower drawdown) with higher returns, resulting in a much higher Sharpe ratio than off-the-shelf products or a more simple risk-weighted approach. Summary fact sheet can be downloaded here.

Robotics has been a popular investing theme with retail and institutional clients in recent years. Popular funds in the space include ETFs such as BOTZ and ROBO as well as high profile actively managed mutual funds.

From 2016 to present these funds attracted billions of dollars in fund flows and have retained those assets while other thematics have ebbed and flowed.

However, such off-the-shelf fund products are necessarily one-size-fits-all solutions.

Many institutional investors have different views on the underlying stocks, a different risk profile or different operational constraints than those expressed in the fund. Such investors can benefit from building a portfolio to invest in the theme themselves.

In this post we’ll explore how institutional investors can apply a systematic portfolio construction process to create a customized robotics portfolio that meets their unique requirements. Using this systematic process, we’ll create an executable robotics portfolio that delivers more of the risk you want and less of the risk you don’t want.

Defining the Problem

The most critical part of implementing a systematic portfolio construction process is getting the inputs right.

This requires asking the right questions consistently to define all of the inputs to the portfolio construction problem in a coherent manner.

We will use this two-step framework below (more detail on the framework here) to set up the problem and then construct our sample Robotics portfolio:

Step 1 – Generate Investment Ideas

-

- How do you determine which assets to include in the portfolio? (Selection)

- How do you differentiate between the assets? (Scores)

Step 2 – Apply the Ideas to Create an Investable Product

-

- What risk do you want to take? (Risk You Want)

- What risks do you NOT want to take? (Risk You Don’t)

- What additional operational constraints are on the portfolio? (Objectives and Constraints)

Step 1 – Generate Investment Ideas

Generating investment ideas is the core competency of most institutional investors. An investor with expertise in this space could define their own list of stocks or provide their own scores. But the Sherpa team are not robotics experts or stock pickers!

As a result, we’ll rely on public data to proxy as our robotics theme idea generation for this example.

Selection

We’ve used the public holdings of the two most popular ETFs in the Robotics space to determine which assets to include in the portfolio – BOTZ and ROBO.

Many of the holdings in these funds overlap, but when combined we have a universe of 106 stocks deemed to have exposure to the Robotics theme.

These ETF constituent stocks will be the assets eligible for inclusion in our sample portfolio.

Scores

With the list of stocks eligible for the portfolio determined, the next step is to score the assets. The scoring process establishes a forward-looking view on the relative prospects of each asset in the portfolio.

In most cases, a fundamental manager would generate scores or views for this step as part of their research process. Examples include conviction scores, estimated values, price targets, or any other quantifiable way to distinguish between the analyst’s views on the asset.

For this exercise we’ll again use a public source for demonstration – Bloomberg’s Analyst Consensus score of 1.00 to 5.00 for each stock.

Step 2 – Shape Portfolio

Once we have selected and scored the stocks that will be included, we need to define the portfolio’s “shape”. This process requires resolving different stakeholder requirements to establish the desired risk and return characteristics of the resulting portfolio.

This explicit ex-ante specification of the portfolio shape is critical in building a portfolio that meets those investor requirements.

Shaping the portfolio requires establishing

- the Risk You Want,

- the Risk(s) You Don’t Want, and

- any operational Objectives and Constraints on the portfolio.

The Risk You Want

A long-only portfolio will make for an apples-to-apples comparison to general robotics products.

One could also create a long-hedged or pure long-short expression of the theme depending on how much exposure to market risk we’re willing to accept here.

In this portfolio construction problem we will look to maximize exposure to our analyst scores. That is to say the risk of the portfolio should be driven by the strength of the scoring. Higher Analyst Consensus scores should be given greater weight in the portfolio while lower Analyst Consensus scores should have lower weights.

Risk You Don’t

Given high realized volatility in robotics funds in the past, our risk-mitigation will focus on limiting damaging drawdowns and reducing overall portfolio volatility.

Other risks we might attempt to mitigate include market beta, factor risks, macro factors or any other exposure for which an investor wishes to control.

Long-hedged or pure long-short expressions of the robotics theme would have more flexibility in terms of risk mitigation than a long-only portfolio. We’ll cover those examples in future posts.

Objectives and Constraints

The last step is to specify any operational constraints around liquidity, turnover, position sizing, country or sector allocations, etc.

To ensure the portfolio can be implemented as a strategy at investable scale, we’ve specified constraints on liquidity and individual asset position sizing. These limits are set so that the portfolio is executable at a minimum of $50mn USD AUM.

As a result, position limits have been set to no more than 10% of the average daily trading volume (ADTV) for any given position.

These liquidity constraints allow us flexibility in terms of rebalancing the portfolio. Lower trading costs allow the portfolio to be rebalanced as frequently as weekly, making for a more responsive portfolio versus index strategies reconstituted at most semi-annually.

We’ve also defined constraints around country and sector concentration to ensure the portfolio retains a similar set of exposures to the ETFs used to define our stock universe.

Construct the Portfolios

Once we have fully defined the portfolio construction problem answering the questions above, we can use a maths engine to construct a portfolio that best meets our requirements.

At Sherpa Funds Technology we use our patented Optimal Risk Sizing (ORS) technology to construct portfolios, though other mathematical tools could also be applied here.

To illustrate the benefits of using a systematic portfolio construction approach, we’ll compare the resulting portfolio with:

- the original two ETFS, BOTZ and ROBO,

- a simple Risk Weighted portfolio created using all 106 stocks included in our universe

Systematic Portfolio Construction Results

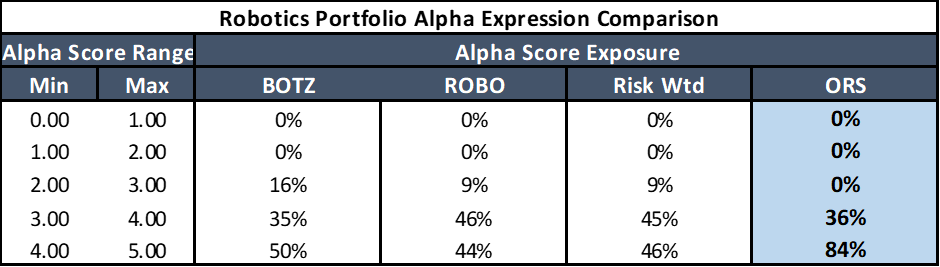

1 – More of the Risk You Want

In shaping our systematic portfolio, we specified that we want to maximize the expression of the asset scores in our portfolio.

The Risk Weighted approach is very similar to the two ETFs, with around half of the portfolio allocated to the highest score assets (4 to 5) and around 10% to the lowest score assets (2 to 3).

The ORS portfolio gives a much greater weight to the highest score assets with 84% of the portfolio in highly scored names. It excludes entirely the lowest scored assets.

As a result, the ORS portfolio gives greater exposure to our scores (ie. analyst inputs) than the off-the-shelf products or a more simplistic portfolio construction method.

Our systematic ORS portfolio is being driven by what we defined ex-ante as the risk we want to take.

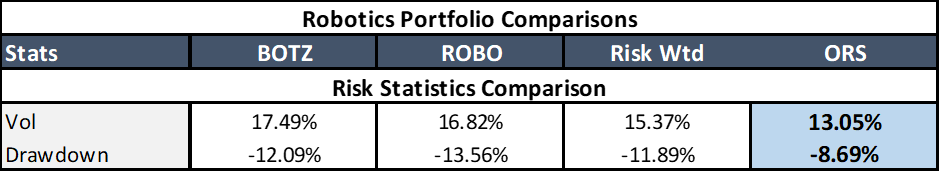

2 – Less of the Risk You Don’t

The second element of the shaping process defined the risks we wanted mitigated in our portfolio construction. Here we are limiting damaging drawdowns and reducing volatility to produce a more risk-controlled expression of the volatile robotics theme.

A simple risk weighted portfolio reduced both volatility and drawdown when compared to the ETFs, as we might expect with a risk targeted methodology.

However, the ORS robotics portfolio showed lower volatility and drawdown than all three other portfolios. Volatility and drawdown were both around 25% lower than the original ETFs.

Simply put, the ORS portfolio helps mitigate the risk we don’t want.

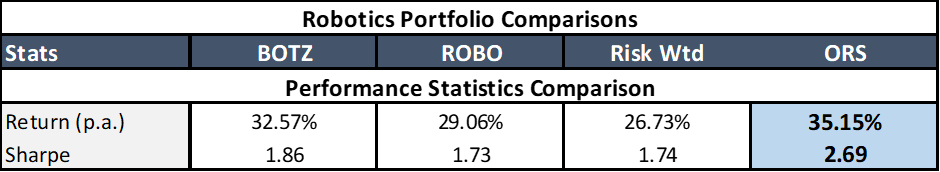

3 – Improved Performance

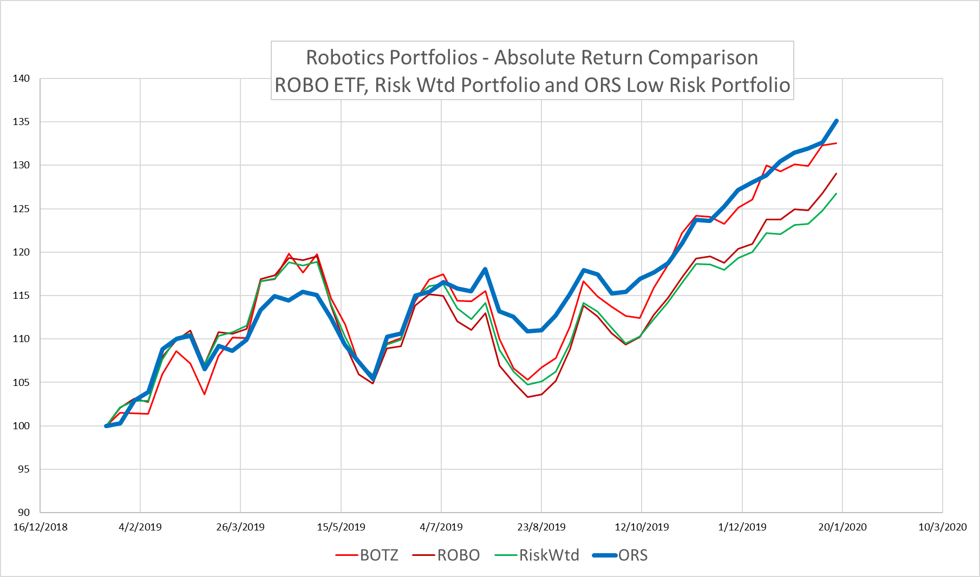

Finally, we look at the backtested performance of the 4 portfolios over the last year to examine the impact of the various methodologies on overall portfolio returns.

The naïve risk weighted approach dampened the returns generated by the two underlying ETFs. While it produced the lowest returns over the past year, it managed a similar Sharpe ratio as the ETFs due to its overall lower levels of risk.

The ORS portfolio, on the other hand, outperformed all three benchmark portfolios in absolute returns by at least 250 bps p.a. When combined with the lower level of volatility, this produced a Sharpe of 2.69 – almost a full point higher than the other three portfolios.

The risk-mitigated ORS portfolio also had a “smoother ride” with smaller drawdowns in both Q2 and Q3 2019 compared with the other 3 portfolios.

In terms of exposure to the risk we wanted to take, risk-control and absolute returns, the systematically constructed portfolio handily outperformed both the off-the-shelf options and the traditional risk weighted alternative.

Summary

As our Robotics example illustrates, using a systematic portfolio construction process to create thematic portfolios can deliver more of the risk you want and less of the risk you don’t while retaining the value in the underlying investment ideas.

This focus on expressing the desired risks delivers greater returns when your thematic thesis is correct, with lower drawdowns when the thesis doesn’t perform as anticipated.

Systematic portfolio construction methods can offer institutional investors a scalable alternative to one-size-fits-all products or simpler do-it-yourself position sizing methods.

Summary fact sheet can be downloaded here.

To discuss ORS Systematic Thematics or learn more about Sherpa Funds Technology’s process-driven approach to portfolio construction, get in touch here or sign up for the SFT mailing list.