Know Your Factor Risk Bets

Summary: Residual factor risk is a critical consideration in the portfolio construction process. The reversal of long-standing factor trends in 2020 and 2021 have underlined the importance of Knowing Your Factor Bets. Factor shocks can easily swamp a fund manager’s asset selection alpha, or even drive results inconsistent with the fund’s mandate. Good portfolio construction requires measuring and understanding the underlying factor bias in your process and portfolio so that you can make more informed decisions to take “More of the Risk You Want, Less of the Risk You Don’t.”

Watch the related “Know Your Factor Bets” webinar at the link.

Understanding the Problem – Know Your Factor Bets

Equity markets post-COVID have seen a spike in volatility in well-known equity risk factors such as Value, Growth, Momentum, etc. Multiple factor rotations have made headlines for sharp short-term moves.

Fund managers blindly positioned for a continuation of prior factor return trends may have been confronted with hard conversations with their investors or management.

Constructing a portfolio that thrives in different types of factor environments requires the PM to understand the factor exposures inherent in their alpha generation. Only then can they determine the factor risk they are comfortable with in their book and build their portfolio so that it is positioned to best take that risk.

To get the “Risk You Want” you must first understand the risk you have.

Knowing your Factor Bias is a Key to Getting the Risk You Want

For a PM to get the best expression of their alpha consistent with their desired amount of factor risk they need to complete three main steps:

- Identify the factor bias in your alpha

- Decide what, if any, factor bias you’re comfortable with in your portfolio

- Construct a portfolio so that it expresses your desired factor bias

In this post we will illustrate the impact of different higher-level factor risk decisions using data from one of our systematic External Alpha Signal providers. This will show how factor risk has the potential to drive portfolio results regardless of the PM’s intentional factor decisions.

Understanding how factor risk fits in to the portfolio construction problem is an important step in ensuring your portfolio takes “More of the Risk You Want, and Less of the Risk You Don’t.”

Let’s Revisit… Four Varying Market-Risk Portfolios From Same Alpha

In our prior post on Long/Short Equity Portfolio Construction we leveraged a systematic alpha source to construct four different portfolio expressions of the alpha with different levels of market risk.

All 4 portfolios were constructed using the same alpha signal but varying levels of market exposure. These were

- 130/30 net long

- Hedged long-biased portfolio

- Cash-neutral market-neutral portfolio

- Factor-neutral market-neutral portfolio.

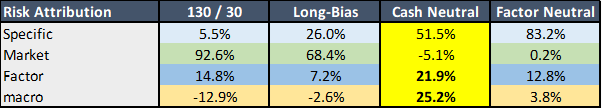

Beyond just looking at how market exposure impacted the Specific Risk alpha expression of the signal, we also illustrated where residual factor risks could drive portfolio results.

Even in a cash-neutral market-neutral portfolio almost 50% of the risk was explained by factor and macro risks.

Breaking the risk attribution down further showed that the sample portfolio’s very strong historical performance was largely a result of a long growth – short value factor bet and a long bond exposure.

Over the period in question those residual risk bets worked out very well as we can see in the table below. The Cash Neutral portfolio produced much higher returns when those residual risk factors worked in its favor.

Factor Bias is Generally a Fact of Life

This is an illustration of something Sherpa sees with fund managers regularly. Almost all alpha will have some type of factor bias as a result of the unique process used to generate differentiated high-quality ideas.

Regardless of the unique USP of the analyst, PM, signal provider, etc – whether a matter of universe definition, quantitative screens, tendencies in the individual analysts / PMs – any replicable process will most likely have some resulting bias or tendencies.

These resulting biases can typically be expressed as residual factor or macro risks.

One of the first steps in constructing a portfolio that best expresses that alpha then is identifying any resulting factor bias. Then the PM can make an informed decision on how to handle those factor bets.

How You Handle Residual Factor Risk is of Critical Importance

As we have discussed in prior posts and videos, there is no one-size-fits-all answer for what constitutes appropriate risks for a portfolio. This applies for market risk, factor risk, macro risk – any type of risk. The appropriate risks for a portfolio are those you have sold to your investors.

With that in mind, we can group portfolios into three types with regards to factor risk. The first two are OK… the last is more problematic:

- Intentional Factor Bet portfolios are positioned to consciously express the factor exposures the PM desires… think a growth PM having strong growth factor exposure

- Factor-Neutralized portfolios are constructed to minimize all residual factor risks to isolate only the selection alpha… think low vol, high specific-risk, long/short

- Unintentional Factor Bet portfolios have residual factor risks that the PM is unaware of or doesn’t really want… think landmines.

If you have told your investors you’ll take factor bets, either from a timing perspective or as an underlying driver of your strategy, then those factor bets form a core part of the portfolio.

Similarly, if you sell your investors on a high Specific Risk strategy with minimal factor risk you have a clear definition of the risk you’re seeking to deliver.

Taking unintentional factor bets, however, can introduce unanticipated and unwelcome sources of volatility to your portfolio’s performance. This is the opposite of taking the Risk You Want!

To intentionally manage factor bias, first we have to identify it.

There are Many Ways to Measure Factor Bias

There are many ways to calculate the factor exposure in a portfolio, but the one we will use in the following examples can be simplified as:

-

- Calculate the asset factor loadings

- Sum (Factor Loadings x Alpha signal) for each asset

Factor loadings can be obtained from Bloomberg or calculated by internal quants, by Sherpa or other external providers. Generally speaking the precise calculation of the loadings is less important than the broad direction and magnitude of any factor bias.

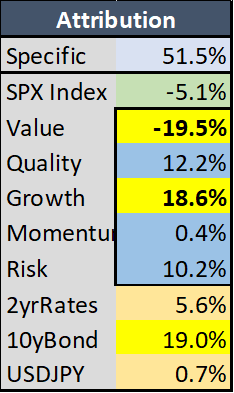

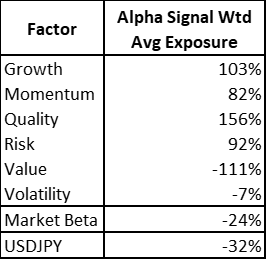

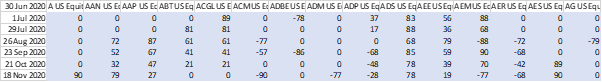

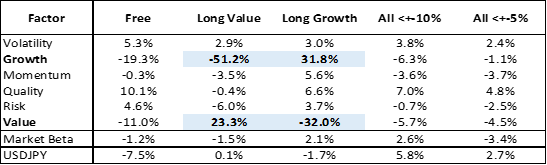

Using this method the resulting Factor Bias table for our Alpha Signal is shown below. Just as we might anticipate from the prior portfolios, the signal shows a persistent long growth / short value bias, as well as a meaningful long quality bias.

As a reminder, the signal consists of a set of convictions on most liquid 700 of the Russell 1,000 stocks. The conviction scores identify stocks on both the long and short side and are updated monthly. Again, the following analysis is all out-of-sample real portfolio data driven by this signal.

Again, absent any explicit handling of this factor bias in our portfolio construction we’d expect any resulting portfolios built from these stock selections to have a strong growth vs value tilt.

How Can We Manage that Factor Bias?

To illustrate a few ways to handle that factor bias we used Sherpa’s Optimal Risk Sizing engine to create 5 different market-neutral long/short equity portfolios.

All use the same external alpha signal above, the same amount of leverage, the same targeted level of risk, and the same set of constraints around position size, etc. The only variation is in the objective handling of factor risk exposure.

We built the following 5 portfolios:

- “Free” has no constraints or targeting in terms of factor bets

- “Long Value” is constructed with an intentional long value bias

- “Long Growth” is constructed with an intentional long growth bias

- “All <+-10%” constrains all factor exposures to less than plus or minus 10%

- “All <+-5%” constrains all factor exposures to less than plus or minus 5%

Let’s Look at the Portfolios in More Detail

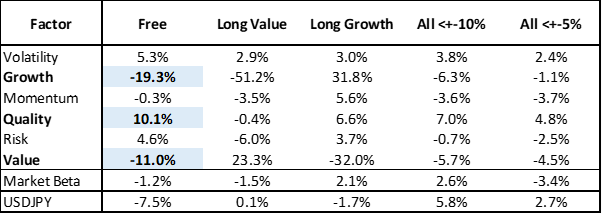

All 5 portfolios have minimal market beta – they are both cash and beta neutral. Varying exposure or market risk won’t explain the differences we see in the portfolios.

The Free portfolio has meaningful residual factor risk – in this case short value and growth and long quality.

The portfolios constructed to have targeted factor exposures – Long Value and Long Growth – very clearly express those factors with very little residual exposure to other factors. The signal’s underlying quality bias is neutralized.

Finally the factor-neutralized portfolios have very little factor exposure, with slightly more in the 10% option than the more heavily constrained 5% option.

So What Do We Expect from These Portfolios?

In our example at the top of the post, the Free (not factor constrained) Portfolio showed IMPROVED returns versus the factor-neutralized example. See the yellow line on the graph again.

That time period had steady, consistent factor returns – Growth steadily outperformed Value and the short Value bias paid off handsomely.

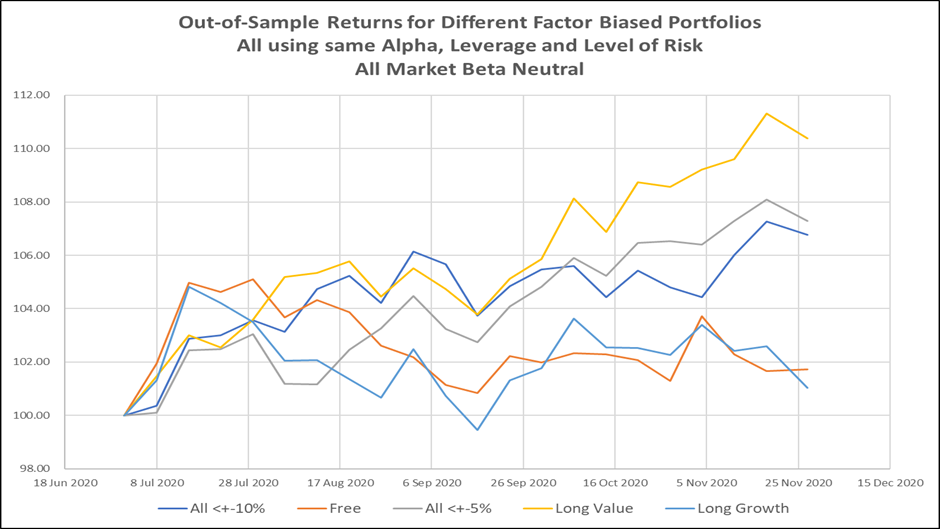

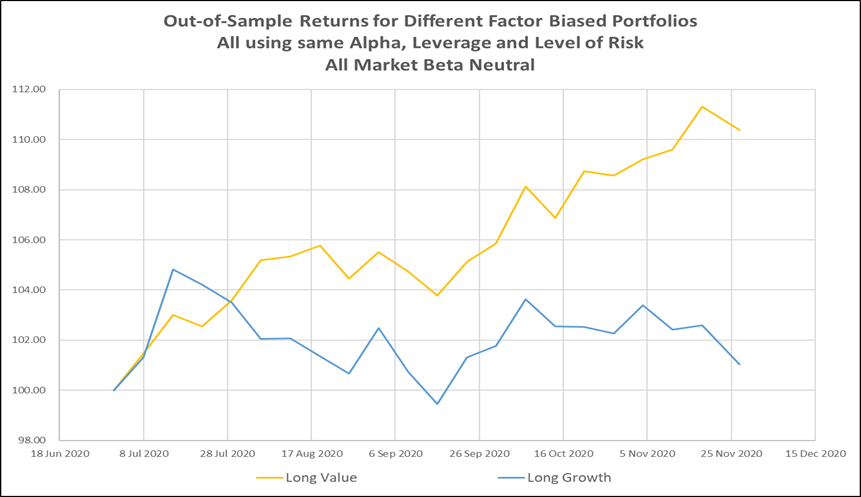

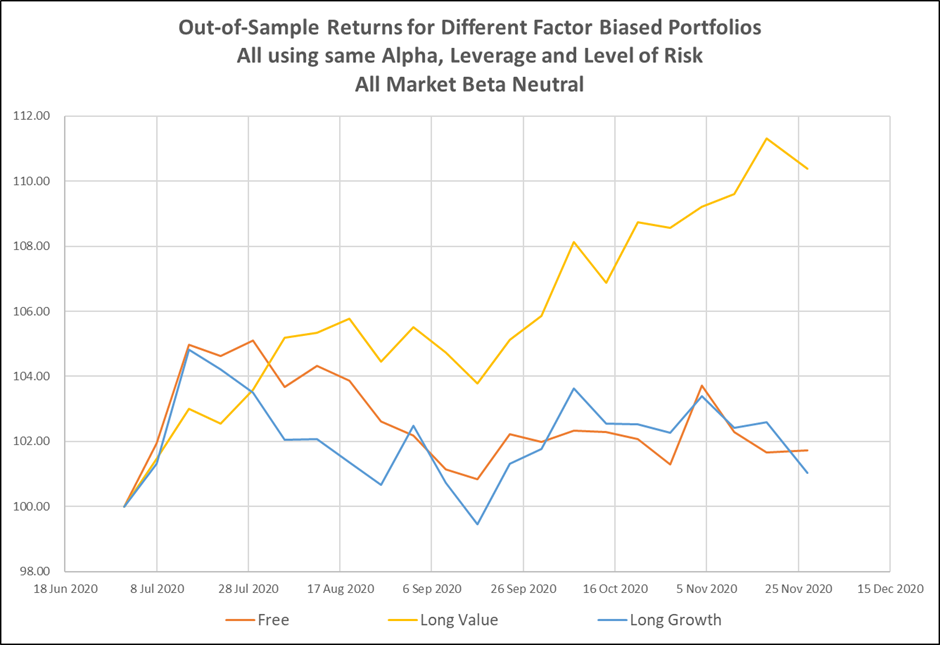

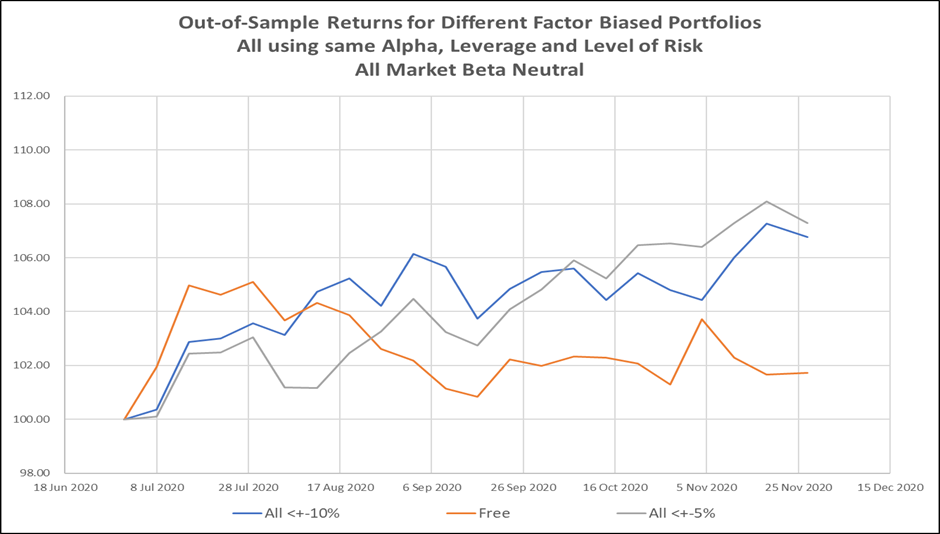

However, looking at out-of-sample returns for the 5 portfolios constructed above through the end of 2020 shows huge differences in outcome. Remember the only difference between the portfolios is the handling of factor risk. But there is a 10% difference in returns over just this 6 month period!

The different factor risk exposures produced very different outcomes, especially when compared to the factor performance from the first half of 2020.

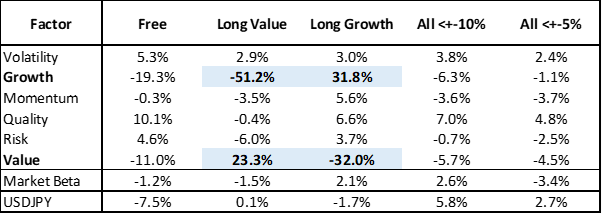

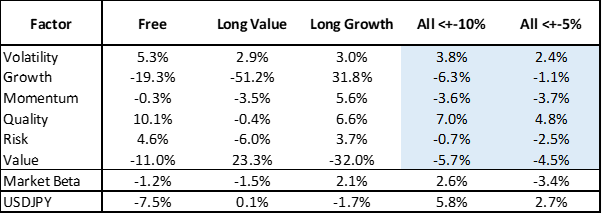

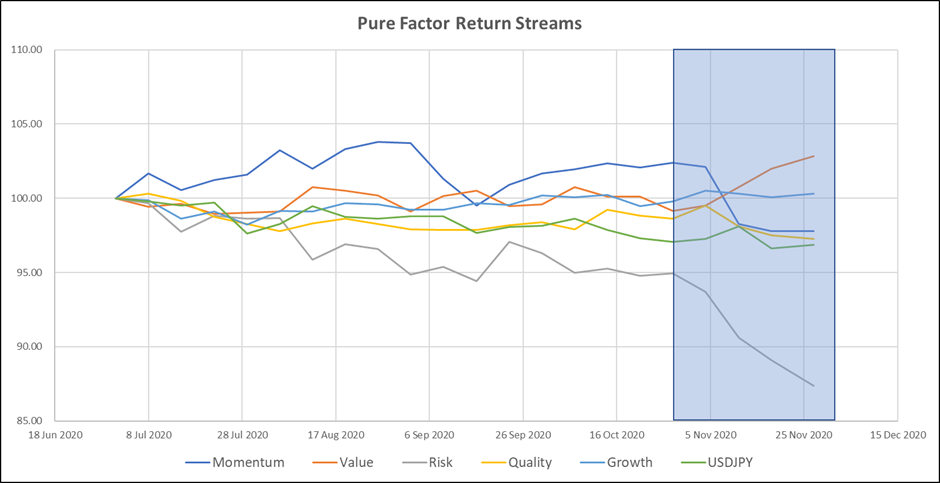

To show how this might be driving the portfolio performance, let’s look at how each of the factors performed during the factor volatility in H2 20202 to see if the original growth / value ‘bet’ has continued to pay off.

Significant Volatility in Factor Returns, Esp During Late Oct – Nov 2020

Before we look how these factors impacted the returns of our portfolios, remember how these 5 portfolios fit into our three factor-risk approaches:

- Intentional Factor Bets – Long Value and Long Growth make intentional factor bets

- Factor Neutralized – 5% and 10% +/- Neutralized seek to mitigate factor bets

- Unintentional Factor Bets – Free ends up with whatever factor exposure was in signal

The Intentional Factor Bet portfolios generated returns that largely mirrored the underlying factor return streams. As the market rotated into value during the end of the period the Long Value portfolio posted strong results, while the Long Growth portfolio lagged as the short value exposure dragged down returns.

The Unintentional Factor Risk Free portfolio also suffered from the short value positioning.

Finally, the Factor Neutralized portfolios both generated steady returns, albeit at a lower rate than those boosted by riding the value rally. These portfolios offered exposure just to the underlying alpha in the stock selection signal.

Big Differences from Same Alpha and Top-Level Constraints

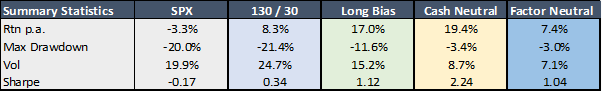

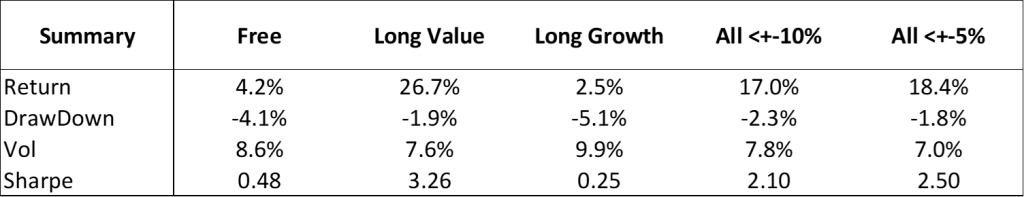

All portfolios had similar levels of volatility as per our construction objectives.

Intentional Factor Bet portfolios had MASSIVELY different returns – a 24% swing between getting the factor bet right or wrong.

Factor Neutralized portfolios returned 17-18% p.a. – strong alpha returns.

The Unintentional Factor Bet portfolio returned only 4.2%. The asset selection alpha is totally swamped by the factor exposures, giving up 75% of the possible alpha returns.

Portfolio managers taking unintentional factor bets risk realizing the third scenario – their asset selections are good but their portfolio performance is poor due to unintended factor bets!

Explicitly considering factor risk is a critical part of a good portfolio construction process that lets you better take the Risk You Want to take.

The Keys to Remember Regarding Factor Risk Exposure

This boils down to a few key takeaways when thinking about factor risk:

- If you have ex-ante factor exposures, expect factor-driven returns.

- Factor-driven returns can swamp or magnify Alpha.

- Like market risk, factor risk is not bad per se – but it must be consistent with what you have sold your investors.

- Not making conscious factor exposure bets IS a decision, and your returns will show the results.

As with market risk questions and other portfolio construction topics, the Sherpa team has extensive experience helping PMs navigate these questions to construct portfolios that take the RIGHT risks in a more intentional manner. If you’ve been whipsawed by factor volatility drop us a line and we’d love to chat.

To see the potential impact of improved portfolio construction on your portfolio and learn more about refining your team’s portfolio construction process, get in touch with the Sherpa team or sign up for the SFT mailing list here.