by Richard Waddington | Oct 14, 2023 | Asset Management, Process Alpha

AI, IA and AM: Robots for Asset Managers Everybody has heard about Artificial Intelligence, or A.I. However for asset managers I.A., or Intelligence Augmentation, is far more important. A.I. has long been part of the public consciousness, more due to Sci-Fi than...

by Richard Waddington | Aug 5, 2022 | Portfolio Construction, Risk Management

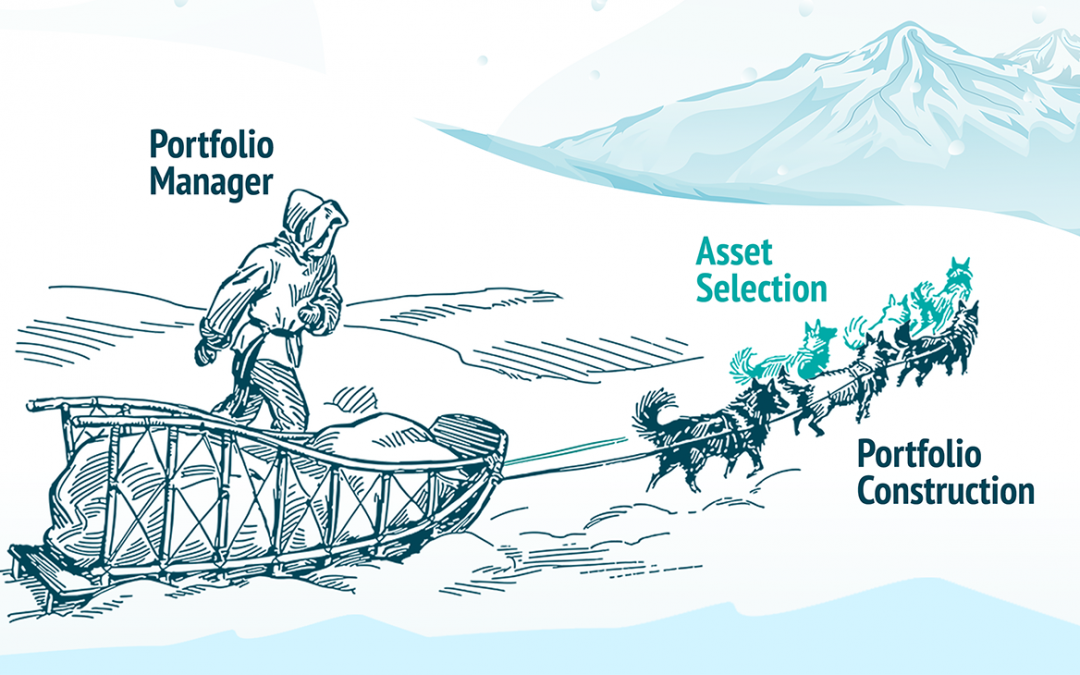

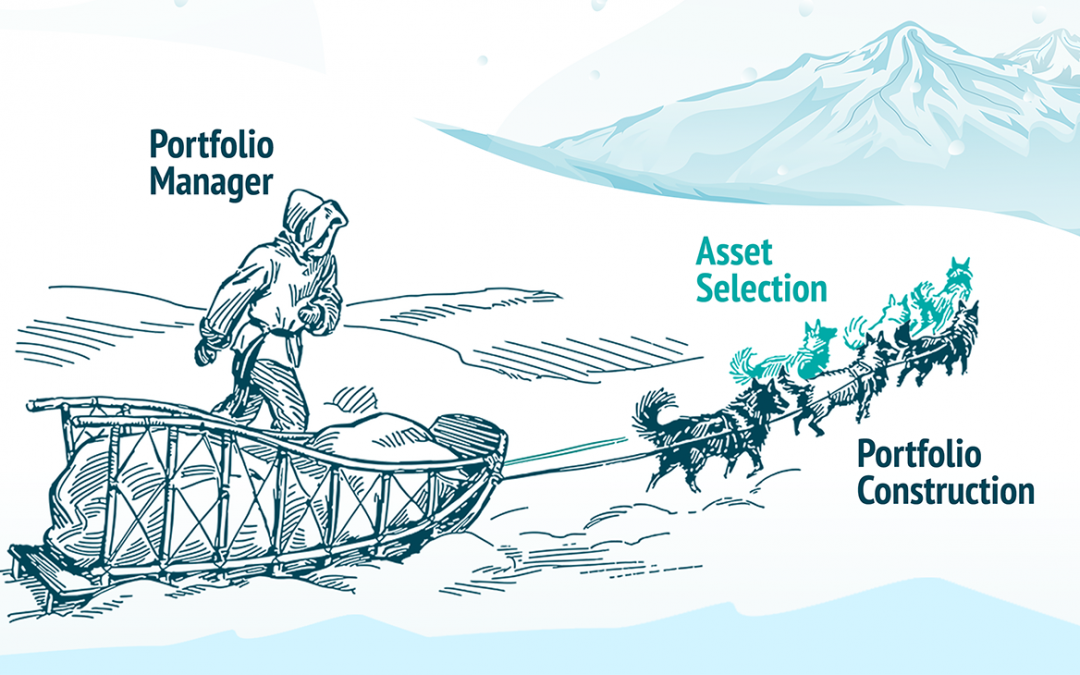

We have often described how Sherpa Funds Technology helps Portfolio Managers generate better returns from their asset selection and convictions, and we have gone into some detail about how we do this, and what the Sherpa process involves. So now let’s look at the...

by Steven Quimby | Jul 13, 2022 | Asset Management, Portfolio Construction, Process Alpha

Have You Considered Running a Center Book? Multi-manager and multi-analyst fund management organizations generate a huge amount of asset selection information with the potential to add alpha to the firm, but few truly maximize the value of that information in the...

by Richard Waddington | May 18, 2022 | Asset Management, Portfolio Construction, Position Sizing, Risk Management, Stocks

Portfolio Managers need to balance many competing objectives and constraints while expressing their views across a large number of assets. This is a complex problem and it is hard to find a way of showing that the solution (the invested portfolio) meets these...

by Steven Quimby | Apr 11, 2022 | Portfolio Construction, Process Alpha

Do You Understand Why Portfolio Construction Matters? Traders often say the right idea at the wrong time is as bad as the wrong idea. Similarly, a poorly constructed portfolio of good ideas can destroy most, or even all, of the alpha in a PM’s stock selection. Despite...

by Richard Waddington | Feb 11, 2022 | Portfolio Construction

In the world of Asset Management, the Portfolio Manager is King. I write ‘King’ as it remains a profession dominated by men: according to Morningstar, 86% of portfolio managers in 2021 were men, a proportion that has remained unchanged for 20 years. This blog is not...

by Steven Quimby | Jun 23, 2021 | Portfolio Construction, Process Alpha, Risk Management

Know Your Factor Risk Bets Summary: Residual factor risk is a critical consideration in the portfolio construction process. The reversal of long-standing factor trends in 2020 and 2021 have underlined the importance of Knowing Your Factor Bets. Factor shocks can...

by Richard Waddington | Oct 14, 2020 | Asset Management, Portfolio Construction

Art vs Science – Have we progressed since 1959? In 1959, the British scientist and novelist C.P. Snow gave a lecture on how art and science separated people. It caused a huge furor which has continued to this day. Snow argued that people who sat on one side of...

by Richard Waddington | Oct 14, 2020 | Asset Management, Portfolio Construction, Process Alpha, Uncategorized

Robo-Advisors, 2/3rds of the way there… It’s 2018, Robo-cop doesn’t yet exist, but Robo-Advisors are very much ‘in’. And it’s not hard to see why. Businesses like US-based Wealthfront and UK-based Nutmeg promise to build anyone a portfolio that suits their risk...

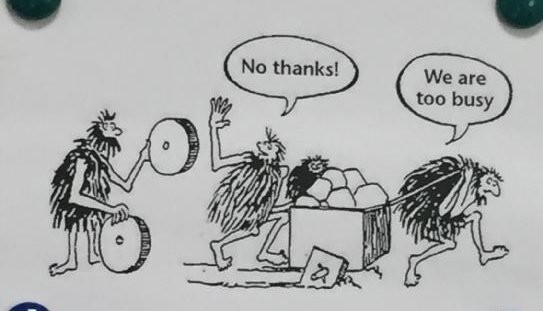

by Richard Waddington | Oct 14, 2019 | Asset Management

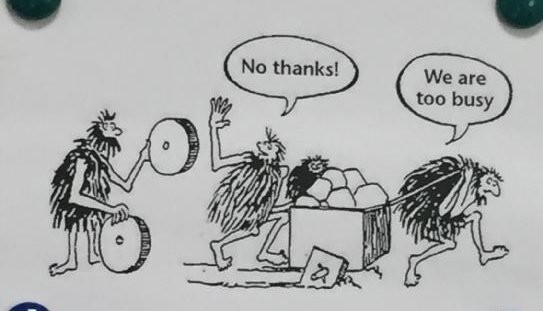

Asset Management and the struggle with innovation I saw the cartoon above on LinkedIn a while back, and I’ve been thinking about what’s going through the minds of the team dragging the box: not least because they remind me of how it sometimes is when you work in...